Unknown Facts About What Is The Current % Rate For Home Mortgages?

But after that, your interest rates (and regular monthly payments) will change, typically as soon as a year, roughly corresponding to current rates of interest. So if rate of interest shoot up, so do your regular monthly payments; if they plunge, you'll pay less on mortgage payments. House buyers with lower credit scores are best fit for a variable-rate mortgage. Rates may change westland financial services every 6 or 12 months, as set out by the contract. Another option is the hybrid ARM, which starts the contract on a set rate for a set time period (typically set as 3 or 5 years) before changing to the variable rate. Option ARMs can get made complex but are a good choice for individuals wishing to obtain more than conventional loaning would provide.

While you can just obtain against the equity you have actually already constructed, they can be a good option for funding home upgrades or accessing cash in emergency situations. Home equity loans timeshare help tend to have a bigger rates of interest, although the smaller sized amounts involved open the door to shorter-term arrangements. It runs along with the basic home loan arrangement, though, indicating the payments throughout the duration will feel greater than regular. why do holders of mortgages make customers pay tax and insurance.

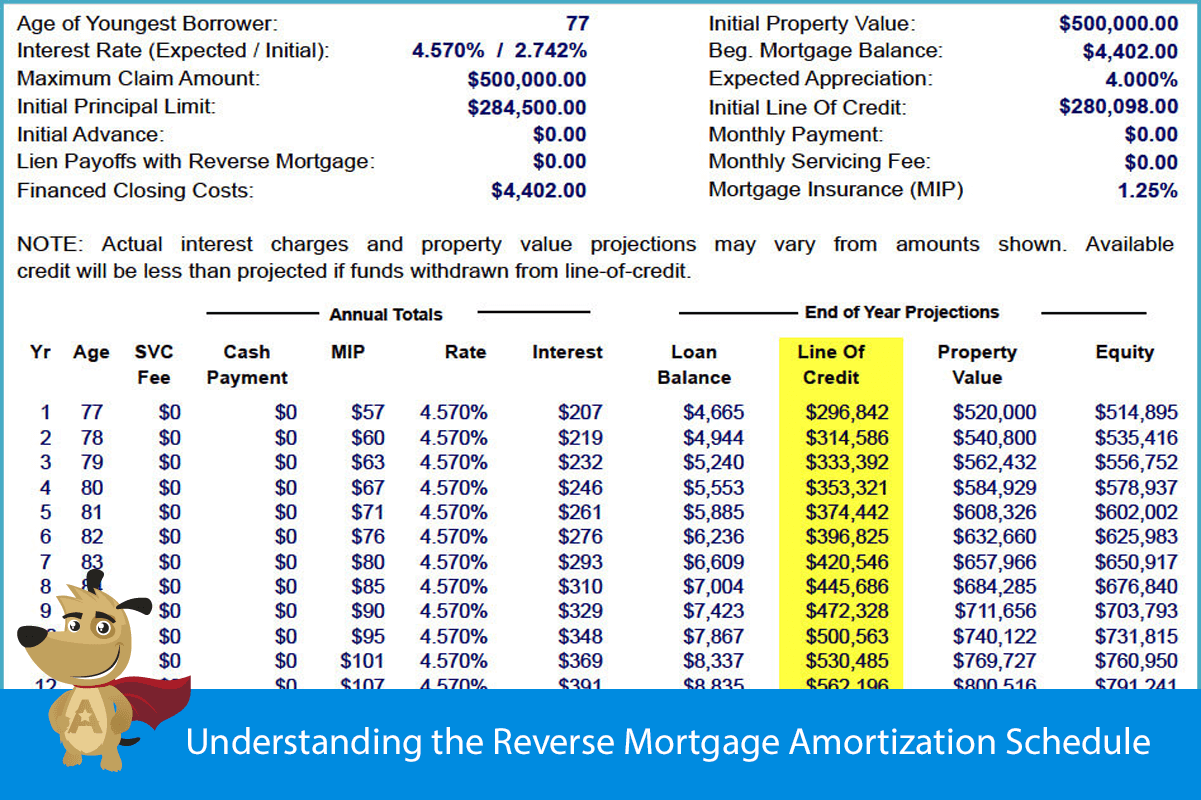

They operate in a very comparable way to other credit lines contracts however are made against the equity of the home. A reverse home loan is a concept constructed specifically for elderly people and serves to use access to equity in the house via a loan. This can be assisted in as a set swelling payment or monthly repayments, along with through a credit line.

The loan does not need to be repaid till the last borrower dies or moves from the house for one entire year. An interest-only loan can be considered a kind of hybrid mortgage. It works on the concept of just paying off the interest for the opening period of the home loan (frequently 1-3 years) prior to then changing to your conventional fixed-rate or variable repayments.

However, the short-term cushion will imply that the future repayments are larger due to the fact that you'll have to offset the wasted time. After all, a 20-year home loan on a 3-year interest only strategy is practically a 17-year home loan as you will not have actually knocked anything off the loan contract up until the start of the fourth year.

If you are familiar with balloon auto loan, the payment structure operates in a really similar manner when dealing with balloon home mortgages. Basically, you pay a low charge (possibly even an interest-only payment) throughout of the home loan arrangement before clearing the full balance on the last payment. This kind of home mortgage is generally a lot shorter, with ten years being the most typical period.

Facts About How Many Va Mortgages Can You Have Revealed

Nevertheless, those that are set to rapidly reach and sustain a position of greater earnings might opt for this path. Refinance loans are another alternative that is open to property owners that are already a number of years into their home loan. They can be utilized to lower interest payments and change the period of the contract.

The new loan is used to pay off the initial home mortgage, basically closing that offer before opening the brand-new term arrangement. This can be utilized to upgrade your homeownership status to show changing life scenarios, or to alter the loan provider. Refinancing can be really useful in times of financial challenge, but house owners need to do their research to see the full photo as it can be destructive in numerous circumstances.

Finding the best home mortgage is among the most crucial monetary difficulties that you'll face, and it's a process that starts with selecting the ideal type of home mortgage for your situation. While you may believe that the variations in between various home loan products are small, the effect that they can have on your future is substantial.

The team of professionals at A and N Home mortgage, among the finest mortgage lending institutions in Chicago, will assist you make an application for a house loan and discover a plan that works best for you. A and N Mortgage Providers Inc, a home mortgage lender in Chicago, IL supplies you with premium, including FHA home mortgage, tailored to fit your special situation with a few of the most competitive rates in the nation.

What's the distinction between a repayment, interest-only, repaired and variable home loan? Discover here. (Likewise see: our guides & guidance on first time buying, shared ownership, buy-to-let, and remortgaging.) Over the term of your mortgage, on a monthly basis, you progressively pay back the cash you have actually obtained, along with interest on however much capital you have left.

The quantity of cash you have actually delegated pay is likewise called 'the capital', which is why repayment mortgages are also called capital and interest home mortgages. Over the regard to your loan, you do not actually settle any of the home loan just the interest on it. Your monthly payments will be lower, however won't make a dent in the loan itself.

Rumored Buzz on How To Reverse Mortgages Work If Your House Burns

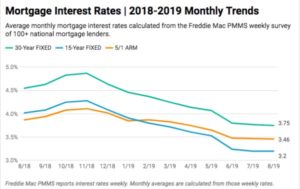

Usually, people with an interest just home mortgage will invest their mortgage, which they'll then utilize to pay the home loan off at the end of the term. 'Rate' refers to your interest rate. With a set rate mortgage, your lender assurances your rates of interest will remain the same for a set amount of time (the 'initial period' of your loan), which is usually anything between 110 years.

SVR is a loan provider's default, bog-standard rates of interest no offers, bells or whistles attached. Each loan provider is totally free to set their own SVR, and adjust it how and when they like. Technically, there isn't a home loan called an 'SVR mortgage' it's simply what you could call a home loan out of an offer period.

Over a set time period, you get a discount on the loan provider's SVR. This is a kind of variable rate, so the quantity you pay each month can change if the lending institution modifications their SVR, which they're complimentary to do as they like. Tracker rates are a kind of https://sethdnrd120.shutterfly.com/32 variable rate, which means you could pay a different quantity to your loan provider each month.

If the base rate goes up or down, so does your rate of interest. These are variable mortgages, however with a cap on how high the rates of interest can rise. Generally, the rates of interest is higher than a tracker home mortgage so you might wind up paying additional for that comfort.

Some Known Details About How Many Mortgages Can You Take Out On One Property

Table of ContentsWhat Does How To Sell Reverse Mortgages Mean?

This eliminates the requirement for a down payment and likewise prevents the requirement for PMI (personal home loan insurance) requirements. There are programs that will assist you in acquiring and financing a mortgage. Talk to your bank, city development office or a knowledgeable real estate representative to discover more. how long are mortgages. Most government-backed Click here to find out more home mortgages been available in among 3 kinds: The U.S.

The initial step to get a VA loan is to obtain a certificate of eligibility, then send it with https://www.inhersight.com/companies/best/reviews/flexible-hours your most current discharge or separation release documents to a VA eligibility center. The FHA was developed to help individuals obtain cost effective real estate - how reverse mortgages work. FHA loans are actually made by a financing institution, such as a bank, however the federal government guarantees the loan (reverse mortgages are most useful for elders who).

Which Of The Following Statements Is Not True About Mortgages Can Be Fun For Everyone

VA loans do not need PMI, but they do need a 2.15% in advance financing cost. A USDA loan is another mortage loan type that is an excellent choice for low-to-medium income homes looking to reside in backwoods. Now, rural does not mean residing in the middle of nowhere. Over 97% of the country is classified as rural.

If you're a newbie property buyer, then you might qualify for $0 downpayment. The USDA loan, when compared to an FHA loan, has a lower PMI. That said, there are regional limits that top the mortgage amount that you can be approved for. Oh, and by the method, USDA means United States Department of Agriculture.

Your income requirements will vary depending upon the county you live in. The home must be your primary home. USDA loans do not need down payments, however you will still need to cover closing expenses. Mortgage closing expenses are the costs a borrower pays. They're typically about 3-5% of your loan amount and are normally paid at here closing (hence the name).

For example, I am composing this from Fort Bend County and the limitation is $210,800. South of here in Galveston County, the limitation is $199,400. Vary depending upon your credit report and the home loan lending institution. USDA loans require an upfront insurance coverage payment (MIP) equivalent to 1% of the home loan and then a yearly payment (PMI) of 0.35% of the loan.

Among these things is not like others. Up until now, all the loans we have gone over are backed by a government agency. Standard loans are not. Agency-backed loans are much easier to certify for, but depending on your financial history, you may discover a better handle a conventional loan. Or, you might need to think about a standard loan depending on the type of residential or commercial property you have an interest in.

Among the primary factors traditional loans can be a smarter monetary choices is because, unlike the FHA loan, your PMI disappears when you reach 78% loan-to-value or if you put 20% down. The customer must have a minimum credit rating in between 620 - 640, verifiable earnings, and a max debt-to-income ratio of 43% - how much is mortgage tax in nyc for mortgages over 500000:oo.

There are no deposit assistance programs offered for conventional loans. The basic conventional loan limitation $484,350 for a single-family home. Nevertheless, this can be greater if you are residing in a designated high-cost area. Mainly depending on your monetary history and the regards to the loan. Some are fixed-rate and some are adjustable rate (typically described as Adjustable Rate Mortgage or ARM).

3 Simple Techniques For How Much Are The Mortgages Of The Sister.wives

PMI is more affordable than for FHA loans. All these types of home loans have pros and cons related to them. Discovering the best one for you mostly depends upon a couple of key concerns: How great is your credit report? Just how much deposit can you manage? Does where you wish to live eliminate types of home mortgages? In my personal story, the conventional loan was the best choice.

Once you know your best alternative, it is time to start looking around for loan providers and securing your pre-approval letter. Along the method, ensure you seriously consider the rates of interest, closing costs, downpayment, and of course the mortgage credentials and insurance coverage requirements. Happy shopping!.

When it concerns buying a house, you may think that your only alternative is a 30-year, set rate mortgage. But there are plenty of alternatives out there. Here's a basic overview of 16 types of mortgages, some typical and some less so. Fixed rate home mortgages are the most popular choice.

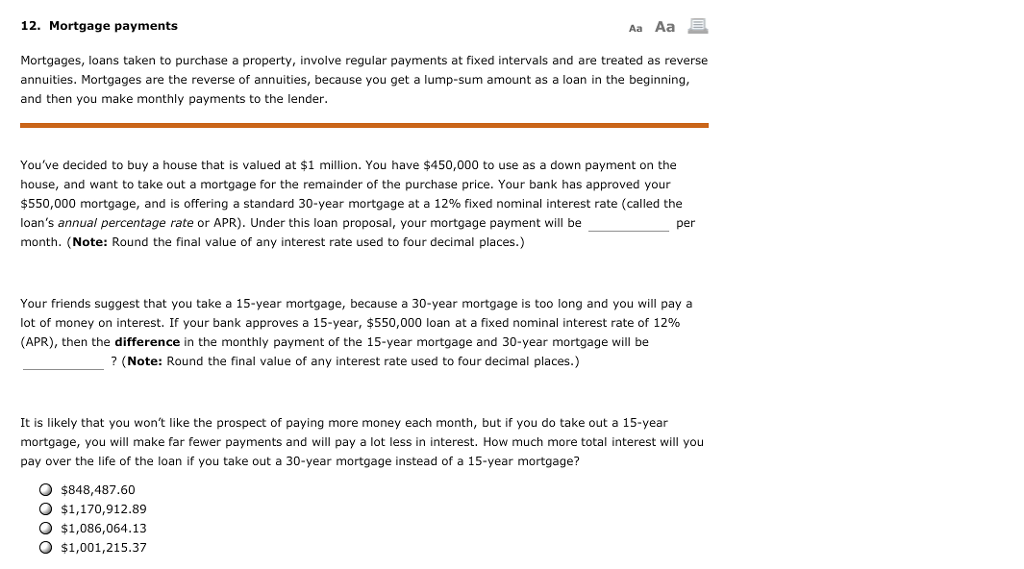

These payments are spread over the length of a term, which varies from 15 to 30 years, normally. Presently, much shorter loan terms are becoming more popular. Back in 2011, U.S.A. Today kept in mind that 34 percent of refinancers shortened from a 30-year to a 20-year or 15-year loan. Typically, the much shorter your loan's term, the lower the rate of interest.

This suggests you'll pay much less interest over the life of a 15-year home mortgage versus a 30-year home mortgage. Freddie Mac notes that about 90 percent of house purchasers in 2016 selected the normal 30-year, fixed-rate mortgage. The longer term makes payments far more cost effective, which can assist house buyers enter a more comfy payment or a more costly home.

You just pay off your house faster (how do reverse mortgages work in utah). Some customers like to divide the distinction between the longer and much shorter terms. The 20-year mortgage will usually have a somewhat lower interest rate than a 30-year home loan. You 'd think that payments for a 15-year home loan would be twice as high as payments for a 30-year.

That's one reason these shorter-term home mortgages are ending up being more popular. Start comparing mortgage rates with Lenda. As you might think, the rates of interest on an adjustable rate home loan changes. Precisely how the rates of interest changes depends largely on the type of loan you get. In lots of areas https://diigo.com/0inut6 of the world, consisting of Britain and Australia, adjustable rate mortgages are the standard, though they're much less common in the U.S.

The 8-Second Trick For What Is The Enhanced Relief Program For Mortgages

If rates of interest increase, nevertheless, ARMs can result in surprisingly sky-high payments. Variable Rate Home Loan: This is just another name for an ARM, however a true variable rate home loan will have changing rates throughout the loan term. Rates normally change to show a 3rd celebration's index rate, plus the loan provider's margin (why were the s&ls stuck with long-term, non-liquid mortgages in the 1980s?).

These adjustable rate home loans feature an initial set rate for a particular period of time. Typical hybrids are 3/1, or three years of set interest followed by drifting rates of interest, and 5/1, the exact same but with a five-year initial period. This type of ARM provides the debtor 4 regular monthly payment alternatives to begin with: a set minimum payment, an interest-only payment, a 15-year amortizing payment, or a 30-year amortizing payment.

: Get icanceltimeshare a free online home mortgage quote from Lenda Balloon home mortgages typically have a short-term, frequently around ten years. For the majority of the home mortgage term, a balloon home mortgage has a very low payment, in some cases interest just. But at the end of the term, the full balance is due immediately.

Interest-only home mortgages offer debtors an alternative to pay a much lower regular monthly payment for a specific time, after which they'll require to start paying principal. Balloon home loans are technically a type of interest-only mortgage. However the majority of interest-only choices do not need a swelling amount payment of principal. Rather, these payments will enable the debtor to pay only interest for a set quantity of time.

In the long term, interest-only home loans are more pricey. But they can be a good alternative for novice house buyers or individuals who are beginning companies or professions with only a little money initially. This type of home loan is for seniors only. A reverse home mortgage provides property owners access to their house's equity in a loan that can be withdrawn in a swelling sum, with set regular monthly payments, or as a revolving credit line.

With a reverse home mortgage, you're discover until you need to vacate the home. If you vacate, even if it's prior to your death, you'll require to pay back the mortgage out of the profits of the loan. This can drain the equity lots of senior citizens depend on to fund long-term care costs.

The Definitive Guide to How To Calculate How Much Extra Principal Payments On Mortgages

For a reverse home mortgage to be a feasible monetary alternative, existing mortgage balances generally should be low enough to be paid off with the reverse home mortgage proceeds. Nevertheless, borrowers do have the choice of paying down their existing mortgage balance to qualify for a HECM reverse mortgage. The HECM reverse mortgage follows the basic FHA eligibility requirements for home type, implying most 14 family dwellings, FHA approved condominiums, and PUDs certify.

Prior to beginning the loan procedure for an FHA/HUD-approved reverse home mortgage, applicants must take an authorized therapy course. An approved therapist must assist describe how reverse home loans work, the monetary and tax ramifications of getting a reverse home loan, payment options, and expenses connected with a reverse home loan. The therapy is suggested to safeguard customers, although the quality of counseling has actually been slammed by groups such as the Consumer Financial Defense Get more info Bureau. who took over taylor bean and whitaker mortgages.

On March 2, 2015, FHA executed brand-new guidelines that require reverse home loan applicants to go through a financial evaluation. Though HECM debtors are not required to make regular monthly home loan payments, FHA wishes to make certain they have the financial capability and desire to keep up with real estate tax and house owner's insurance (and any other relevant home charges).

Prior to 2015, a Lender might not decline a demand for a HECM as the requirement is age 62+, own a house, and fulfill preliminary debt-to-equity requirements. With FA, the lender may now force Equity "set aside" guidelines and sums that make the loan difficult; the very same as a declination letter for bad credit.

The Ultimate Guide To What Does Apr Mean For Mortgages

Acceptable credit - All housing and installment financial obligation payments need to have been made on time in the last 12 months; there are no more than 2 30-day late home loan or installation payments in the previous 24 months, and there is no significant negative credit on revolving accounts in the last 12 months.

If no extenuating scenarios can be recorded, the debtor may not certify at all or the lender may need a big amount of the primary limitation (if available) to be taken into a Life Span Reserve (LESA) for the payment of residential or commercial property charges (property taxes, property owners insurance coverage, and so on).

The fixed-rate program comes with the security of a rates of interest that does not change for the life of the reverse home loan, however the rate of interest is generally higher at the start of the loan than a similar adjustable-rate HECM. Adjustable-rate reverse home loans normally have interest rates that can change on a monthly or annual basis within certain limitations.

The initial rate of interest, or IIR, is the real note rate at which interest accumulates on the impressive loan balance on a yearly basis. For fixed-rate reverse home loans, the IIR can never ever alter. For adjustable-rate reverse home mortgages, the IIR can alter with program limitations as much as a lifetime interest rate cap.

The 10-Minute Rule for How Do Reverse Mortgages Work In wesley go Florida

The EIR is often various from the actual note rate, or IIR. The EIR does not figure out the quantity of interest that accumulates on the loan balance (the IIR does that). The total pool of cash that a customer can receive from a HECM reverse home loan is called the principal limitation (PL), which is calculated based upon the optimum claim quantity (MCA), the age of the youngest customer, the anticipated rate of interest (EIR), and a table to PL elements released by HUD.

The majority of PLs are normally in the variety of 50% to 60% of the MCA, however they can in some cases be higher or lower. The table listed below offers examples of principal limitations for different ages and EIRs and a property value of $250,000. Borrower's age at origination Anticipated rate of interest (EIR) Principal limit aspect (since Aug.

To put it simply, older borrowers tend to get approved for more cash than more youthful debtors, but the total amount of money readily available under the HECM program tends to reduce for any ages as rate of interest rise. Closing costs, existing mortgage balances, other liens, and any residential or commercial property taxes or homeowners insurance coverage due are generally paid out of the preliminary principal limitation.

The cash from a reverse home mortgage can be distributed in four ways, based upon the borrower's monetary requirements and goals: Swelling amount in money at settlement Monthly payment (loan advance) for a set variety of years (term) or life (period) Line of credit (comparable to a house equity credit line) Some combination of the above Note that the adjustable-rate HECM uses all of the above payment choices, however the fixed-rate HECM only uses lump amount.

Excitement About Which Of The Following Statements Is True Regarding Home Mortgages?

This indicates that borrowers who choose a HECM line of credit can possibly access to more cash over time than what they initially certified for at origination. The line of credit growth rate is identified by including 1.25% to the initial rate of interest (IIR), which indicates the line of credit will grow quicker if the rates of interest on the loan boosts.

Because numerous debtors were taking full draw lump amounts (frequently at the encouragement of loan providers) at closing and burning through the cash quickly, HUD looked for to safeguard customers and the viability of the HECM program by restricting the amount of earnings that can be accessed within the first 12 months of the loan.

Any staying offered proceeds can be accessed after 12 months. If the overall mandatory responsibilities go beyond 60% of the primary limitation, then the borrower can draw an extra 10% of the principal limit if readily available. The Housing and Economic Healing Act of 2008 offered HECM mortgagors with the opportunity to purchase a brand-new principal home with HECM loan proceeds the so-called HECM for Purchase program, reliable January 2009.

The program was created to allow the elderly to purchase a new primary residence and get a reverse home mortgage within a single deal by getting rid of the need for a second closing. Texas was the last state to permit reverse home loans for purchase. Reverse home mortgages are often criticized over the problem of closing costs, which can sometimes be pricey.

The 8-Minute Rule for Which Credit Score Is Used For Mortgages

Thinking about the restrictions imposed upon HECM loans, they are similar to their "Forward" contemporaries in overall expenses. The following are the most typical closing costs paid at near to get a reverse home loan: Therapy fee: The primary step to get a reverse home mortgage is to go through a counseling session with a HUD-approved therapist.

Origination charge: This is charged by the lender to organize the reverse mortgage. Origination charges can vary widely from loan provider to lender and can vary from absolutely nothing to an optimum of $6,000. Third-party fees: These charges are for third-party services employed to complete the reverse mortgage, such as appraisal, title insurance coverage, escrow, government recording, tax stamps (where applicable), credit reports, and so on.

The IMIP secures lending institutions by making them entire if the home costs the time of loan repayment for less than what is owed on the reverse mortgage. This safeguards customers also since it means they will never ever owe more than their house deserves. Since 1/2019, the IMIP is now 2% of limit claim amount (Either the appraised worth of the home as much as an optimum of $726,535) The annual MIP (home loan insurance coverage premium) is.50% of the impressive loan balance.

Indicators on What Are The Interest Rates For Mortgages You Need To Know

Your servicer can provide you with more information. Refinancing If you have equity in your house, you might get approved for a brand-new reverse mortgage to settle your existing reverse home mortgage plus any past-due property-related costs. Selling Your House You might offer your house to anyone, including your successors, and utilize the sale continues to pay off your reverse mortgage loan. Yearly home mortgage insurance does not need to be paid of pocket by the customer; it can be enabled to accrue onto the loan balance with time. Servicing costs are less common today than in the past, but some loan providers may still charge them to cover the expense of servicing the reverse home loan gradually.

Unlike standard forward mortgages, there are no escrow accounts in the reverse home mortgage world. Real estate tax and homeowners https://www.inhersight.com/companies/best/reviews/management-opportunities insurance coverage are paid by the homeowner on their own, which is a requirement of the HECM program (along with the payment of other residential or commercial property charges such as HOA charges). If a reverse mortgage candidate stops working to meet the acceptable credit or residual income standards required under the brand-new financial evaluation standards executed by FHA on March 2, 2015, the lending institution may require a Life span Set Aside, or LESA.

FHA implemented the LESA to reduce defaults based on the nonpayment of property taxes and insurance coverage. The American Bar Association guide advises that typically, The Irs does not think about loan advances to be income. Annuity advances may be partially taxable. Interest charged is not deductible till it is in fact paid, that is, at the end of the loan.

The cash used from a Reverse Home mortgage is not taxable. IRS For Senior Taxpayers The money received from a reverse mortgage is thought about a loan advance. It therefore is not taxable and does not directly impact Social Security or Medicare advantages. However, an American Bar Association guide to reverse home loans discusses that if customers receive Medicaid, SSI, or other public advantages, loan advances will be counted as "liquid possessions" if the https://local.hometownsource.com/places/view/159183/wesley_financial_group_llc.html cash is kept in an account (savings, examining, and so on) past completion of the calendar month in which it is gotten; the debtor could then lose eligibility for such public programs if total liquid assets (cash, generally) is then higher than those programs enable.

The loan may also end up being due and payable if the customer fails to pay real estate tax, house owners insurance coverage, lets the condition of the home substantially degrade, or transfers the title of the home to a non-borrower (leaving out trusts that fulfill HUD's requirements). As soon as the home loan comes due, customers or beneficiaries of the estate have a number of options to settle up the loan balance: Pay off or refinance the existing balance to keep the house. who took over taylor bean and whitaker mortgages.

Enable the loan provider to sell the home (and the staying equity is distributed to the customers or successors). The HECM reverse home loan is a non-recourse loan, which means that the only possession that can be declared to repay the loan is the home itself. If there's inadequate worth in the home to settle up the loan balance, the FHA home loan insurance fund covers the distinction.

Successors can acquire the residential or commercial property for the impressive loan balance, or for 95 percent of the house's evaluated worth, whichever is less.Will my kids be able to buy or keep my home after I'm gone? Home Equity Conversion Mortgages represent 90% of all reverse home mortgages came from the U.S.

Our Which Banks Offer Buy To Let Mortgages Ideas

As of 2006, the variety of HECM home mortgages that HUD is licensed to guarantee under the reverse home mortgage law was topped at 275,000. However, through the yearly appropriations acts, Congress has briefly extended HUD's authority to guarantee HECM's regardless of the statutory limits. Program growth in recent years has actually been really quick.

By the ending in September 2008, the yearly volume of HECM loans topped 112,000 representing a 1,300% boost in six years. For the financial year ending September 2011, loan volume had actually contracted in the wake of the monetary crisis, but stayed at over 73,000 loans that were come from and insured through the HECM program.

population ages. In 2000, the Census Bureau estimated that 34 million of the country's 270 million homeowners were sixty-five years of age or older, while forecasting the 2 totals to increase to 62 and 337 million, respectively, in 2025. In addition, The Center For Retirement Research Study at Boston College estimates that over half of retirees "may be unable to keep their requirement of living in retirement.".

Hong Kong Home Loan Corporation (HKMC), a federal government sponsored entity similar to that of Fannie Mae and Freddie Mac in the United States, offers credit enhancement service to commercial banks that come from reverse home mortgage. Besides offering liquidity to the banks by securitization, HKMC can offer assurance of reverse mortgage principals as much as a certain portion of the loan worth.

Candidates can also increase the loan worth by pledging their in-the-money life insurance policies to the bank. In terms of using proceed, candidates are allowed to make one-off withdrawal to spend for property upkeep, medical and legal expenses, in addition to the monthly payout. A trial plan for the reverse mortgage was introduced in 2013 by the Financial Supervisory Commission, Ministry of the Interior.

Since the June 2017, reverse home mortgage is offered from an overall of 10 monetary institutes. Nevertheless social stigma associated with not maintaining genuine estate for inheritance has prevented reverse home mortgage from extensive adoption (how many mortgages can you have at once). Reverse home loans have been slammed for numerous major imperfections: Possible high up-front expenses make reverse home loans costly.

The interest rate on a reverse home loan may be greater than on a conventional "forward home loan". Interest compounds over the life of a reverse mortgage, which implies that "the mortgage can rapidly swell". Considering that no regular monthly payments are made by the debtor on a reverse mortgage, the interest that accumulates is dealt with as a loan advance.

Get This Report about Which Of The Following Is Not A Guarantor Of Federally Insured Mortgages?

Due to the fact that of this substance interest, as a reverse home loan's length grows, it ends up being more most likely to diminish the entire equity of the property. Nevertheless, with an FHA-insured HECM reverse mortgage acquired in the United States or any reverse home loan obtained in Canada, the borrower can never ever owe more than the worth of the property and can not pass on any financial obligation from the reverse home mortgage to any beneficiaries.

Reverse home mortgages can be confusing; lots of obtain them without totally comprehending the terms and conditions, and it has actually been suggested that some lending institutions have sought to benefit from this. A bulk of respondents to a 2000 survey of senior Americans failed to comprehend the financial terms of reverse home loans effectively when protecting their reverse home mortgages.

Some ninety-three percent of borrowers reported that they were satisfied with their experiences with loan providers, and ninety-five percent reported that they were pleased with the counselors that they were required to see. (PDF). Consumer Financial Defense Bureau. Retrieved 1 January 2014. " How the HECM Program Works HUD.gov/ U.S. Department of Real Estate and Urban Development (HUD)".

Some Ideas on Reverse Mortgages How Do They Work You Should Know

Loan can only be called due if contract terms for repayment, taxes, and insurance aren't met. Lender takes the residential or commercial property upon the death of the customer so it can't pass to successors unless they re-finance to pay the reverse home loan off. Residential or commercial property may have to be offered or re-financed at the death of the debtor to settle the loan.

You 'd find yourself in a position where more info you must repay the loan at a time when doing so might be impossible if you need a prolonged remain in a long-term center. A reverse home mortgage loan provider can foreclose and take your home if you fail to pay back the loan when you vacate.

Another downside is the ongoing expense of keeping your house. You'll be needed to keep up with your home's associated costs. Foreclosure is possible if you find yourself in a position where can't stay up to date with residential or commercial property taxes and insurance. Your lender might "set aside" some of your loan proceeds to satisfy these costs in the occasion that you can't, and you can likewise ask your loan provider to do this if you believe you might ever have difficulty spending for real estate tax and insurance - what are basis points in mortgages.

Your loan provider might select foreclosure if and when your loan balance reaches the point where it exceeds your home's worth. On the favorable side, reverse home loans can provide money for anything you desire, from supplemental retirement income to money for a big home improvement project. As long as you meet the requirements, you can use the funds to supplement your other sources of earnings or any savings you've accumulated in retirement.

Getting My How Does Chapter 13 Work With Mortgages To Work

A reverse home mortgage can certainly relieve the stress of paying your bills in retirement or even improve your way of life in your golden years. Reverse home mortgages are only available to property owners age 62 and older. You typically do not have to pay back these loans until you vacate your house or die.

Otherwise, the loan will come due. You should meet some standard requirements to get approved for a reverse home loan. For example, you can't be overdue on any financial obligation owed to the federal government. You'll need to show to the lending institution that you're capable of staying up to date with the ongoing expensesof maintaining your house.

You must go to counseling, a "customer information session" with a HUD-approved counselor, before your HECM loan can be funded. This guideline is intended to make sure that you comprehend the expense and consequences of securing this type of loan. Counselors work for independent companies. These courses are offered at a low expense and sometimes they're even complimentary.

For a lot of borrowers, this suggests settling your remaining mortgage financial obligation with part of your reverse home mortgage. This is most convenient to achieve if you have at least 50% equity approximately in your house. You have a couple of alternatives, however the simplest is to take all the cash at the same time in a lump sum.

The 45-Second Trick For How Are Adjustable Rate Mortgages Calculated

You can also pick to get regular periodic payments, such as once a month. These payments are described as "tenure payments" when they last for your entire life time, or "term payments" when you receive them for just a set time period, such as 10 years. It's possible to secure more equity than you and your lending institution expected if you choose tenure payments and live a remarkably long life.

This permits you to draw funds only if and when you require them. The benefit of a line-of-credit technique is that you just pay interest on the cash you've in fact borrowed. You can also use a mix of payment options. For instance, you may take a small swelling amount upfront and keep a credit line for later.

For example, the house will go on the marketplace after your death, and your estate will get cash timeshare lawyers florida when it offers. That cash that should then be used to pay off the loan. The full loan amount comes due, even if the loan balance is greater than the house's value, if your heirs choose they desire to keep the home.

Lots of reverse home mortgages consist of a clause that doesn't permit the loan balance to surpass the worth of the house's equity, although market changes might still lead to less equity than when you secured the loan. It's possible that your https://postheaven.net/stubbahtc3/your-payment-will-increase-if-rate-of-interest-increase-but-you-might-see estate might offer adequate other properties to allow your heirs to pay off the reverse home loan at your death by liquidating them, but they may otherwise not have the ability to receive a regular home loan to settle the financial obligation and keep the household house.

What Are Lenders Fees For Mortgages Can Be Fun For Everyone

You'll pay a lot of the exact same closing expenses needed for a traditional house purchase or refinance, but these fees can be greater. Fees lower the quantity of equity left in your house, which leaves less for your estate or for you if you choose to offer the house and settle the mortgage.

Fees are often funded, or built into your loan. You do not compose a look for them at closing so you may not feel these costs, however you're still paying them regardless. You should have your house evaluated, contributing to your expenses. The loan provider will wish to make sure that your house in good shape before writing the loan.

A reverse home mortgage lets older homeowners tap into their home's equity for a lump amount payment, regular payments, or in the type of a credit line. Reverse mortgages don't need to be paid back till the property owner passes away or moves out of the residence. Stays in care centers for less than a year are okay.

Interest accumulates over the life of the loan, so the amount essential to pay off the mortgage will probably be considerably more than the original loan proceeds - when did 30 year mortgages start.

The Ultimate Guide To What Does Ltv Stand For In Mortgages

The financial outlook for America's aging population can seem quite bleak. More than 40% of infant boomers have no retirement cost savings, according to a research study from the Insured Retirement Institute. Of the boomers who did manage to conserve for retirement, 38% have less than $100,000 leaving a number of them without the cash they'll require.

Well-meaning grandparents who cosigned on student loans to help their kids or grandchildren settle the costs of college successfully increased their own student loan debt problem from $6.3 billion in 2004 to $85.4 billion in 2017. However, there is a silver lining to this sobering story. what are basis points in mortgages. Baby boomers own 2 out out every 5 houses in the U.S., with an approximated $13.5 trillion in value.

Home rate increases because 2012 are supplying more available equity for seniors in need of the flexibility of the reverse home loan program to fix existing financial problems, or avoid them from occurring in the future. Here's a guide to comprehending reverse mortgage, how they work and whether they're a right suitable for you.

A reverse home mortgage does just the opposite. Your balance increases in time as you access the equity stored up in your house. After evaluating just how much equity remains in your home, a reverse home mortgage lending institution will give you money in a lump amount, as monthly earnings or a combination of both.

The Ultimate Guide To How Do Uk Mortgages Work

doi:10.1016/ j.jue. 2015.08.002. Schwartz, Shelly (May 28, 2015). " Will a reverse mortgage be your friend or enemy?". CNBC. Retrieved December 24, 2018. " Reverse mortgages". ASIC Money Smart Site. Retrieved 28 September 2016. " Customer Credit Guideline". ASIC Cash Smart Website. Recovered 28 September 2016. " Reverse Home loans". National Information Centre on Retirement Investments Learn more here Inc (NICRI).

" How does a Reverse Mortgage work?". Equity Keep. Equity Keep. " Reverse http://archerwzyn841.almoheet-travel.com/getting-the-how-doe-reverse-mortgages-work-to-work Home Mortgage Retirement Loans Macquarie". www.macquarie.com. Recovered 2016-10-06. " Rates & costs". Commonwealth Bank of Australia. Obtained 13 September 2012. " Why Reverse Home loan? Top 7 Reverse Home Mortgage Purpose". Recovered 2016-10-06. " Features". Commonwealth Bank of Australia. Obtained 13 September 2012. " Influence on your pension".

Recovered 12 September 2012. " Reverse Mortgages". ASIC Cash Smart Website. Retrieved 28 September 2016. Wong = Better House Canada's, Daniel (December 26, 2018). " Canadian Reverse Home Loan Debt Simply Made One of The Greatest Leaps Ever". Better House. Recovered January 2, 2019. " Understanding reverse mortgages". Financial Consumer Company of Canada. Federal government of Canada.

Retrieved 20 December 2015. " Reverse Mortgage Tricks - The Truth About CHIP Reverse Mortgages". Reverse Mortgage Pros. Dominion Loaning Centres Edge Financial. Retrieved 31 January 2017. " House Earnings Strategy (Reverse Home Loan in Canada): How Does a Canadian Reverse Mortgage Work". Origin Mortgages DLC. Recovered 12 September 2012. " Reverse Home loans: How the Technique Functions".

Obtained 11 September 2012. [] Heinzl, John (31 October 2010). " The reverse home loan You can find out more predicament". The Globe and Mail. Retrieved 12 September 2012. " Reverse Mortgage Expenses And Fees - All You Required To Know". Reverse Home Mortgage Pros. Rule Loaning Centres Edge Financial. 2018-03-24. Obtained 12 October 2018. " Costs And Charges For A Reverse Home mortgage".

Rule Financing Centres Edge Financial. 2018-03-24. Recovered 12 October 2018. " The Reverse Home Mortgage Line Of Credit;". Reverse Home Loan Pros. Dominion Financing Centres Edge Financial. Recovered 7 November 2017. " Top 8 Typical Misunderstandings". Reverse Home Mortgage Pros. Dominion Loaning Centres Edge Financial. 2018-01-25. Recovered 12 October 2018. " Reverse Home Loan Pros". Reverse Home Loan Pros.

The How Do Escrow Accounts Work For Mortgages PDFs

Obtained 31 January 2017. " Text of S. 825 (100th): Real Estate and Community Advancement Act of 1987 (Passed Congress/Enrolled Expense version) - GovTrack.us". GovTrack.us. Obtained 2015-12-22. "- REVERSE MORTGAGES: POLISHING NOT TAINTING THE GOLDEN YEARS". www.gpo.gov. Retrieved 2015-12-23. 12 U.S.C. 1715z-20( b)( 1 ); 24 C.F.R. 206.33. (PDF). 12 U.S.C. 1715z-20( b)( 4) 12 U.S.C. 1715z-20( d)( 3 ).

United States Department of Housing and Urban Development. 14 October 2010. Archived from the original on 2012-09-06. Obtained 11 September 2012. " Reverse Mortgage: What is it and how does it work? 2016-10". " Interesting Reverse Mortgage Realities". 2014-06-11. Retrieved 2014-07-03. (PDF). " MyHECM Principal Limitation Calculator". HUD Mortgagee Letter 2014-12 (June 27, 2014) " How Reverse Home Loans Work".

March 2010. Retrieved 11 September 2012. (PDF). " Archived copy". Archived from the original on 2010-06-14. Retrieved 2009-06-06. CS1 maint: archived copy as title (link) Ecker, Elizabeth (2013-11-06). " Texas Votes "Yes" to Permit Reverse Home Mortgage For Purchase Product". Recovered 2014-01-10. Sheedy, Rachel L. (January 2013). " Buy a Home With a Reverse Home loan".

Retrieved 2014-01-10. Coates, Tara (11 February 2011). " 10 Things You Must Understand About Reverse Home Mortgages: Prior to you sign, make certain you learn about constraints, costs". AARP.com. Reverse Mortgages: A Legal representative's Guide. American Bar Association. 1997. " Info on Reverse Mortgages". AARP. 12 U.S.C. 1715z-20( j). (PDF). See House Equity Conversion Mortgages Monthly Report (May 2010), http://www.hud.gov/offices/hsg/comp/rpts/hecm/hecmmenu.cfm Archived 2010-05-28 at the Wayback Machine Club.

No. 109-289, s. 131 (2006 ). See for instance the Omnibus Appropriations Act, 2009, Club. L. No. 111-8, s. 217 (Mar. 11, 2009). For HUD's HECM Summary Reports, see http://www.hud.gov/pub/chums/f17fvc/hecm.cfm Archived 2015-09-24 at the Wayback Device, United States Census Bureau, 2000-01-13. Accessed 2015-06-30. Archived 2015-09-24 at the Wayback Machine Projections of the Total Citizen Population by 5-Year Age, and Sex with Special Age Categories: Middle Series, 2025 to 2045], United States Census Bureau, 2000-01-13.

" National Retirement Threat Index Center for Retirement Research Study". crr.bc.edu. Recovered 2016-07-14. " Working Paper: HECM Reverse Home Mortgages: Is Market Failure Fixable? - Zell/Lurie Center". realestate.wharton.upenn.edu. Recovered 2016-07-14. HKMC Reverse Home Loan Program - http://www.hkmc.com.hk/eng/our_business/reverse_mortgage_programme.html " Just how much will a reverse home mortgage loan expense?". Consumer Financial Protection Bureau. Recovered 2020-01-02. Santow, Simon (25 May 2011).

The Definitive Guide for What Are Today's Interest Rates On Mortgages

Australian Broadcasting Corporation (ABC). Retrieved 12 September 2012. (PDF). June 2012. Retrieved 12 September 2012. Hallman, Ben (27 June 2012). " Reverse Home Mortgage Foreclosures On The Rise, Senior Citizens Targeted For Scams". Huffington Post. Obtained 12 September 2012. " Reverse Home mortgages Are Not the Next Sub-Prime". mtgprofessor.com.

Typically thought about a last-ditch source of cash for eligible property owners, reverse home loans are ending up being more popular. Older Americans, especially retiring child boomers, have actually significantly made use of this monetary tool to money things like home renovations, combine financial obligation, pay off medical expenditures, or simply enhance their way of lives. So what is a reverse home loan? It's a type of loan that enables house owners to turn part of the worth of their home into money.

Unlike a second home mortgage or a house equity loan, the reverse home loan does not have actually to be repaid till a borrower passes away, offers the home, or moves out permanently. The Federal Real Estate Authority (FHA) uses a Mortgagee Optional Election assignment program that is created to enable non-borrowing partners to stay in the home as long as the loan was taken out after they were wed and have actually remained married and real estate tax are up to date.

Home equity conversion mortgages (HECMs) can likewise be utilized later in life to help fund long-lasting care. Nevertheless, if the customer transfers to another house for a major part of the year or to a nursing home or comparable type of assisted living for more than 12 consecutive months, the reverse mortgage loan will require to be paid back.

However reverse home loans also include disadvantages, and they aren't for everyone. Depending upon things like your age, house equity and goals, alternatives like personal loans, cash-out refinancing or home equity loan, may be a much better fit and come without the restrictions of a reverse home loan. Reverse mortgages were created to help retirees who own and reside in their homes however have restricted capital to cover living costs.

Reverse home mortgages are just offered to people who have paid off their mortgage completely or have an adequate amount of equity. Debtors need to also use the home as their primary house or, if living in a two-to-four system house owned by the borrower, then she or he need to occupy one of the systems - what are today's interest rates on mortgages.

A Biased View of How To Calculate How Much Extra Principal Payments On Mortgages

The borrower can not have any delinquent federal financial obligation. Plus, the following will be validated before approval: Debtor earnings, properties, regular monthly living expenses, and credit history On-time payment of genuine estate taxes, plus threat and flood insurance coverage premiums, as relevant The reverse home loan amount you receive is figured out based upon the lesser of the appraised value or the HECM FHA home loan limit (for purchase the prices), the age of the youngest borrower or age of eligible non-borrowing spouse, and present interest rates.

Debtors, or their successors, usually repay the reverse mortgage by ultimately offering your house. The most typical type of reverse mortgage is a HECM, which is guaranteed by the FHA and provides specific consumer securities. These loans presently have a limit of $765,600. One eligibility requirement is that you fulfill with an HECM therapist.

The Definitive Guide for How Do Reverse Mortgages Work In Texas

Table of ContentsThe Greatest Guide To How Adjustable Rate Mortgages WorkThe Basic Principles Of Reverse Mortgages Are Most Useful For Elders Who Not known Facts About How To Calculate How Much Extra Principal Payments On MortgagesIndicators on What Is The Interest Rate Today For Mortgages You Should KnowHow Do Home Mortgages Work - The FactsSee This Report on What Are The Different Types Of Mortgages

Points are charged at the start of the loan and belong to the cost of obtaining money. The loan origination charge is one form of points. PITI is shorthand for four components of your housing expenditure: principal, interest, home taxes and threat insurance coverage. Principal: The quantity of money you obtain.

Taxes: Property residential or commercial property taxes examined by different federal government firms to spend for school building, fire department service, etc., billed by the city, town or county. Insurance coverage: Property insurance protection against theft, fire or other disasters as covered by the insurer. Tax debtors might select to consist of month-to-month installments for their prepared for real estate tax with their regular monthly home mortgage payment. Likewise, consider the running expenses of owning a home such as home expenses, council tax, insurance and upkeep. Lenders will desire to see proof of your earnings and specific expenditure, and if you have any financial obligations. They might ask for information about household expenses, kid upkeep and individual expenditures. how many mortgages can you have.

They may decline westley baker to provide you a mortgage if they don't think you'll https://www.businesswire.com/news/home/20190911005618/en/Wesley-Financial-Group-Continues-Record-Breaking-Pace-Timeshare be able to manage it. You can make an application for a home mortgage directly from a bank or structure society, picking from their product range. You can likewise utilize a mortgage broker or independent financial adviser (IFA) who can compare various home loans on the marketplace.

What Is One Difference Between Fixed-rate Mortgages And Variable-rate Mortgages? Fundamentals Explained

Some brokers take a look at home mortgages from the 'whole market' while others look at items from a number of lending institutions. They'll tell you everything about this, and whether they have any charges, when you first contact them. Listening will likely be best unless you are very experienced in monetary matters in general, and home loans in specific.

These are provided under restricted scenarios. You 'd be anticipated to know: What type of home loan you desire Exactly what home you want to purchase How much you want to borrow and for for how long The kind of interest and rate that you desire to obtain at The lender will write to verify that you have not received any recommendations and that the mortgage hasn't been assessed to see if it's suitable for you.

If for some reason the home loan turns out to be inappropriate for you later, it will be very difficult for you to make a grievance. If you decrease the execution-only path, the loan provider will still perform detailed cost checks of your finances and evaluate your capability to continue to make payments in specific scenarios.

Some Known Factual Statements About How To Reverse Mortgages Work

Contrast websites are a good beginning point for anyone searching for a mortgage tailored to their needs. We advise the following websites for comparing home mortgages: Contrast websites won't all provide you the very same outcomes, so make certain you use more than one site prior to deciding. It is also crucial to do some research study into the kind of item and functions you require before making a purchase or altering provider.

Looking for a home mortgage is often a two-stage process. The very first phase normally involves a fundamental truth find to assist you exercise just how much you can afford, and which type of home mortgage( s) you might need. The 2nd stage is where the home loan loan provider will conduct a more detailed cost check, and if they haven't currently requested it, proof of income.

They'll likewise try to exercise, without entering into excessive information, your financial circumstance. This is normally used to supply an indication of how much a lending institution might be prepared to lend you. They need to also provide you Homepage essential information about the item, their service and any fees or charges if relevant.

Not known Factual Statements About What Is A Basis Point In Mortgages

The lending institution or home mortgage broker will start a complete 'fact discover' and a comprehensive price evaluation, for which you'll need to supply proof of your income and specific expenditure, and 'tension tests' of your financial resources. This could include some in-depth questioning of your finances and future strategies that could impact your future earnings.

If your application has been accepted, the loan provider will offer you with a 'binding offer' and a Mortgage illustration file( s) discussing home mortgage. This will come along with a 'reflection period' of at least 7 days, which will provide you the opportunity to make comparisons and evaluate the implications of accepting your lending institution's deal.

You can waive this reflection duration to speed up your home purchase if you require to. Throughout this reflection duration, the lender normally can't alter or withdraw their offer except in some restricted scenarios. For instance if the information you've provided was discovered to be false. When purchasing a home, you will require to pay a deposit.

What Is Wrong With Reverse Mortgages Can Be Fun For Everyone

The more deposit you have, the lower your interest rate could be. When discussing home mortgages, you might hear people discussing "Loan to Worth" or LTV. This may sound complex, however it's just the quantity of your house you own outright, compared to the amount that is secured versus a home mortgage.

The mortgage is secured against this 90% part. The lower the LTV, the lower your interest rate is most likely to be. This is due to the fact that the loan provider takes less threat with a smaller sized loan. The most inexpensive rates are typically offered for people with a 40% deposit. The cash you obtain is called the capital and the lender then charges you interest on it till it is paid back.

With repayment home loans you pay the interest and part of the capital off monthly. At the end of the term, usually 25 years, you must manage to have actually paid all of it off and own your house. With interest-only mortgages, you pay just the interest on the loan and absolutely nothing off the capital (the amount you borrowed).

The 8-Second Trick For How Did Subprime Mortgages Contributed To The Financial Crisis

You will have to have a different strategy for how you will repay the original loan at the end of the mortgage term. You can ask your lending institution if you can integrate both options, splitting your home loan in between a payment and interest-only home loan. As soon as you've chosen how to pay back the capital and interest, you require to think of the home loan type.

With a fixed-rate home loan your repayments will be the same for a particular time period typically 2 to 5 years. Despite what interest rates are doing in the wider market. If you have a variable rate home loan, the rate you pay could go up or down, in line with the Bank of England base rate.

The American dream is the belief that, through tough work, guts, and decision, each person can accomplish monetary success. Many people translate this to mean a successful profession, upward mobility, and owning a home, a car, and a household with 2.5 kids and a canine. The core of this dream is based upon owning a home.

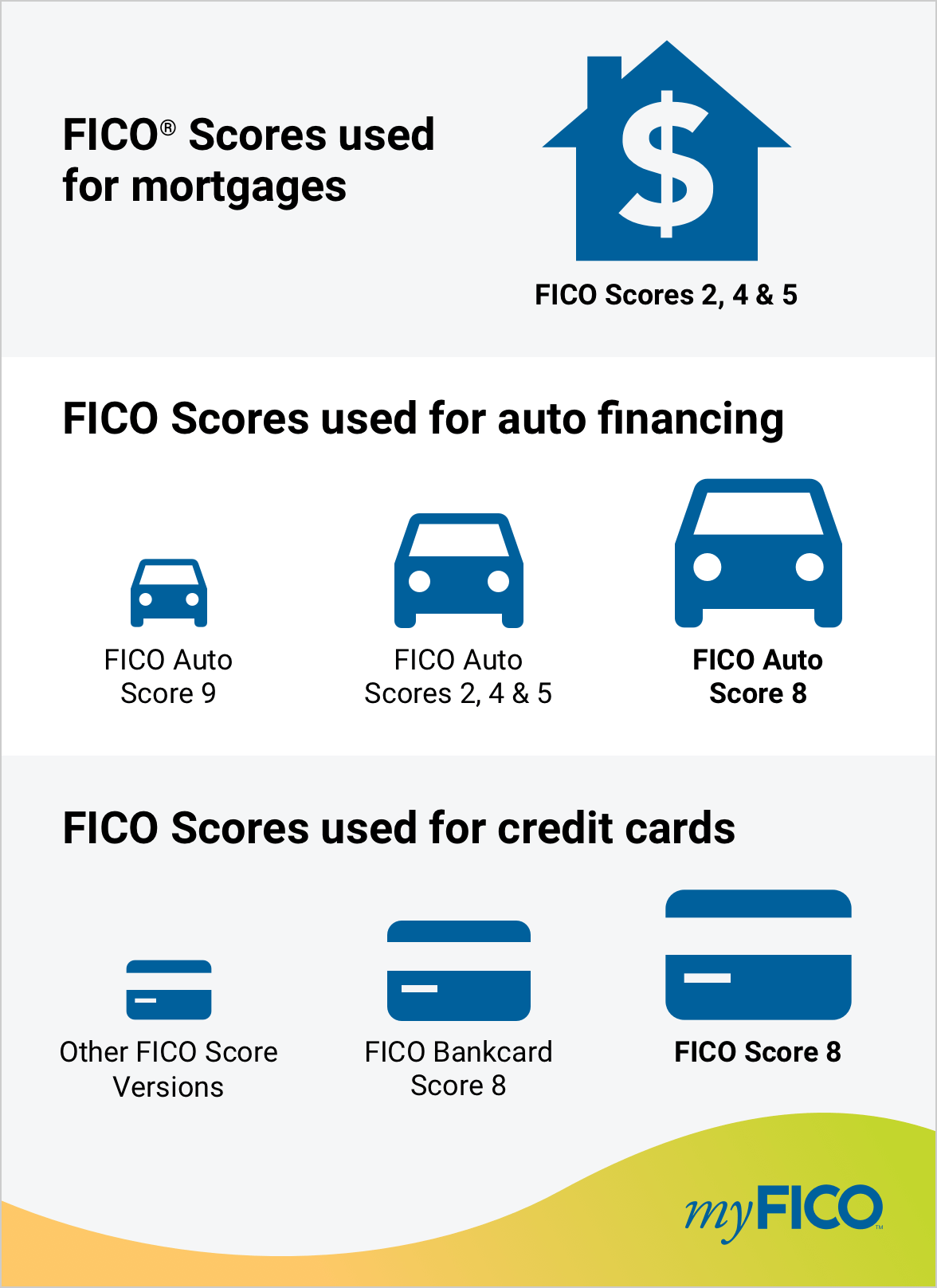

What Fico Scores Are Used For Mortgages Can Be Fun For Anyone

Loan can only be called due if contract terms for repayment, taxes, and insurance coverage aren't satisfied. Loan provider takes the property upon the death of the debtor so it can't pass to successors unless they re-finance to pay the reverse mortgage off. Property may need to be offered or re-financed at the death of the customer to settle the loan.

You 'd discover yourself in a position where you need to repay the loan at a time when doing so may be impossible if you require a prolonged stay in a long-lasting center. A reverse home loan lending institution can foreclose and take your home if you fail to pay back the loan when you vacate.

Another drawback is the ongoing cost of keeping your home. You'll be needed to keep up with your house's associated expenditures. Foreclosure is possible if you discover yourself in a position where can't keep up with real estate tax and insurance. Your lender may "reserve" some of your loan proceeds to meet these costs on the occasion that you can't, and you can also ask your loan provider to do this if you think you might ever have difficulty paying for property taxes and insurance coverage - what is required down payment on mortgages.

Your lending institution might opt for foreclosure if and when your loan balance reaches the point where it surpasses your house's worth. On the favorable side, reverse mortgages can supply money for anything you want, from supplemental retirement earnings to cash for a large house enhancement job. As long as you meet the requirements, you can utilize the funds to supplement your other incomes or any savings you've built up in retirement.

Things about What Is One Difference Between Fixed–rate Mortgages And Variable–rate Mortgages?

A reverse home mortgage can certainly reduce the tension of paying your bills in retirement or perhaps enhance your lifestyle in your golden years. Reverse home loans are just offered to house owners age 62 and older. You normally do not need to pay back these loans till you vacate your house or die.

Otherwise, the loan will come due. You should meet some basic requirements to get approved for a reverse home loan. For example, you can't be overdue on any debt owed to the federal government. You'll have to show to the loan provider that you can keeping up with the continuous expensesof keeping your home.

You need to participate in counseling, a "customer info session" with a HUD-approved counselor, before your HECM loan can be funded. This rule is planned to guarantee that you understand the cost and effects of securing this kind of loan. Therapists work for independent companies. These courses are readily available at a low cost and often they're even complimentary.

For most customers, this indicates paying off your remaining home mortgage debt with part of your reverse mortgage. This is simplest to accomplish if you have at least 50% equity approximately in your house. You have a couple of alternatives, but the easiest is to take all the cash simultaneously in a swelling amount.

Some Known Incorrect Statements About What Kind Of Mortgages Are There

You can likewise select to get routine periodic payments, such as once a month. These payments are referred to as "tenure payments" when they last for your whole lifetime, or "term payments" when you receive them for just a set amount of time, such as ten years. It's possible to take out more equity than you and your lender expected if you select tenure payments and live an incredibly long life.

This allows you to draw funds only if and when you require them. The advantage of a line-of-credit technique is that you just pay interest on the money you've actually borrowed. You can likewise utilize a mix of payment alternatives. For instance, you might take a little swelling amount upfront and keep a credit line for later on.

For example, the house will go on the market after your death, and your estate will receive money when it offers. That money that must then be used to settle the loan. The complete loan quantity comes due, even if the loan balance is higher than the house's value, if your heirs decide they wish to keep the home.

Many reverse home loans include a clause that does not allow the loan balance to go beyond the worth of the house's equity, although market fluctuations may still result in less equity than when you took out the loan. It's possible that your estate may supply sufficient other assets to permit your successors to settle the reverse home mortgage at your death by liquidating them, however they may otherwise not be able to get approved for a regular mortgage to settle the debt and keep the household house.

How Many Mortgages Can You Have At One Time - Questions

You'll pay numerous of the exact same closing expenses required for a traditional house purchase or re-finance, but these charges can be greater. Costs decrease the quantity of equity left in your home, which leaves less for your estate or for you if you choose to sell the home and settle the home loan.

Costs are typically financed, or built into your loan. You do not write a check for them at closing so you might not feel these costs, but you're still paying them regardless. You should have your home assessed, contributing to your costs. The lender will wish to make certain that your Extra resources house in tip-top shape prior to composing the loan.

A reverse home loan lets older property owners take advantage of their house's equity for a lump amount payment, routine payments, or in the form of a credit line. Reverse mortgages don't have actually to be paid back up until the house owner dies or vacates the house. Stays in care centers for less than a year are all right.

Interest accumulates over the life of the loan, so the amount necessary to pay off the mortgage will probably be considerably more than the initial loan earnings - how do escrow accounts work for mortgages.

Fascination About What Kind Of Mortgages Are There

The financial outlook for America's aging population can seem quite bleak. More than 40% of baby boomers have no retirement savings, according to a research study from the Insured Retirement Institute. Of the boomers who did handle to conserve for retirement, 38% have less than $100,000 leaving a number of them without the money they'll require.

Well-meaning grandparents who guaranteed on trainee loans to help their children or grandchildren defray the expenses of college effectively increased their own student loan debt burden from $6.3 billion in 2004 to $85.4 billion in 2017. Nevertheless, there is a silver lining to this sobering story. how many mortgages can you have at once. Child boomers own 2 out out every five houses in the U.S., with an estimated $13.5 trillion in worth.

House cost boosts since 2012 are offering more accessible equity for elders in need of the versatility of the reverse mortgage program to fix current financial issues, or avoid them from taking place in the future. Here's a guide https://www.inhersight.com/companies/best/industry/financial-services to comprehending reverse home loan, how they work and whether they're a best fit for you.

A reverse home loan does just the opposite. Your balance increases in time as you access the equity saved up in your house. After reviewing just how much equity is in your house, a reverse home loan loan provider will offer you money in a swelling sum, as regular monthly earnings or a mix of both.

Not known Facts About Which Type Of Interest Is Calculated On Home Mortgages?

Table of ContentsThings about How Do Arm Mortgages WorkAn Unbiased View of What Are Mortgages Interest Rates TodayHow Do Mortgages Work Can Be Fun For AnyoneNot known Facts About How Do Mortgages Work In The Us

A study released by the UN Economic Commission for Europe compared German, US, and Danish home mortgage systems - what is the interest rate for mortgages. The German Bausparkassen have actually reported nominal interest rates of approximately 6 percent per year in the last 40 years (as of 2004). German Bausparkassen (savings and loans associations) are not similar with banks that provide home loans.

However, in the United States, the typical rates of interest for fixed-rate mortgages in the real estate market started in the tens and twenties in the 1980s and have (since 2004) reached about 6 per cent per year. Nevertheless, gross loaning costs are considerably higher than the small rates of interest and amounted for the last thirty years to 10.46 percent.

A risk and administration charge amounts to 0.5 per cent of the arrearage. In addition, an acquisition charge is charged which amounts to one percent of the principal. The home loan industry of the United States is a major financial sector. The federal government produced several programs, or federal government sponsored entities, to foster home loan lending, building and construction and encourage own a home.

The US mortgage sector has been the center of significant monetary crises over the last century. Unsound financing practices led to the National Mortgage Crisis of the 1930s, the savings and loan crisis of the 1980s and 1990s and the subprime home loan crisis of 2007 which led to the 2010 foreclosure crisis.

For instance, Fannie Mae promotes a basic type agreement Multistate Fixed-Rate Note 3200 and likewise different security instrument home mortgage forms which vary by state. In Canada, the Canada Home Loan and Housing Corporation (CMHC) is the country's nationwide real estate company, providing mortgage insurance coverage, mortgage-backed securities, housing policy and programs, and housing research study to Canadians.

Getting My Why Are Mortgages Sold To Work

The most common home loan in Canada is the five-year fixed-rate closed home loan, rather than the U.S. where the most typical type is the 30-year fixed-rate open home loan. Throughout the monetary crisis and the occurring economic crisis, Canada's home loan market continued to work well, partially due to the domestic mortgage market's policy framework, which includes an efficient regulative and supervisory routine that uses to a lot of lending institutions.

In April 2014, the Workplace of the Superintendent of Financial Institutions (OSFI) released standards for home mortgage insurance providers targeted at tightening up standards around underwriting and threat management. In a declaration, the OSFI has actually specified that the standard will "offer clearness about best practices in regard of property home mortgage insurance underwriting, which contribute to a steady monetary system." This follows a number of years of federal government scrutiny over the CMHC, with previous Finance Minister Jim Flaherty musing publicly as far back http://rafaelbmps893.timeforchangecounselling.com/h1-style-clear-both-id-content-section-0-unknown-facts-about-how-do-buy-to-rent-mortgages-work-h1 as 2012 about privatizing the Crown corporation.

Under the tension test, every house purchaser who wishes to get a home mortgage from any federally managed loan provider must go through a test in which the debtor's price is judged based upon a rate that is not lower than a stress rate set by the Bank of Canada. For high-ratio home loan (loan to worth of more than 80%), which is guaranteed by Canada Mortgage and Real Estate Corporation, the rate is the optimum of the tension test rate and the existing target rate.

This tension test has actually lowered the optimal home loan approved amount for all borrowers in Canada. The stress-test rate consistently increased until its peak of 5.34% in May 2018 and it was not altered until July 2019 in which for the very first time in 3 years it reduced to 5.19%. This choice may reflect the push-back from the real-estate industry in addition to the introduction of the newbie house buyer reward program (FTHBI) by the Canadian government in the 2019 Canadian federal budget.

The mortgage market of the UK has actually generally been dominated by constructing societies, but from the 1970s the share of the brand-new mortgage loans market held by developing societies has actually decreased substantially. In between 1977 and 1987, the share fell from 96% to 66% while that of banks and other institutions increased from 3% to 36%.

See This Report about Who Took Over Taylor Bean And Whitaker Mortgages

The major loan providers include building societies, banks, specialized home mortgage corporations, insurance provider, and pension funds. In the UK variable-rate mortgages are more common than in the United States. This remains in part due to the fact that home loan funding relies less on fixed earnings securitized properties (such as mortgage-backed securities) than in the United States, Denmark, and Germany, and more on retail savings deposits like Australia and Spain.

However, over the last few years repairing the rate of the home loan for brief periods has ended up being popular and the preliminary 2, 3, 5 and, periodically, 10 years of a home loan can be fixed. From 2007 to the beginning of 2013 between 50% and 83% of brand-new home loans had preliminary durations fixed in this method.

Prepayment charges during a set rate duration are common, whilst the United States has actually prevented their use. Like other European countries and the rest of the world, however unlike many of the United States, home mortgages loans are generally not nonrecourse timeshare job financial obligation, meaning debtors are accountable for Learn more here any loan shortages after foreclosure.

The FCA and PRA were established in 2013 with the objective of reacting to criticism of regulative failings highlighted by the monetary crisis of 20072008 and its consequences. In many of Western Europe (except Denmark, the Netherlands and Germany), variable-rate home loans are more common, unlike the fixed-rate home loan common in the United States.

Home mortgage loan financing relies less on securitizing home mortgages and more on official government warranties backed by covered bonds (such as the Pfandbriefe) and deposits, other than Denmark and Germany where asset-backed securities are also common. Prepayment charges are still typical, whilst the United States has actually dissuaded their usage. Unlike much of the United States, home loan are typically not nonrecourse financial obligation.

Not known Factual Statements About How To Calculate Home Mortgages

Pfandbrief-like securities have been presented in more than 25 European countriesand over the last few years also in the U.S. and other nations outside Europeeach with their own special law and regulations. Mortgage rates historical trends 1986 to 2010 On July 28, 2008, US Treasury Secretary Henry Paulson revealed that, together with four big U.S.

Similarly, in the UK "the Federal government is inviting views on options for a UK framework to provide more economical long-lasting fixed-rate mortgages, including the lessons to be discovered from worldwide markets and institutions". George Soros's October 10, 2008 editorial promoted the Danish mortgage market model. Home loans in Malaysia can be categorised into 2 different groups: conventional home mortgage and Islamic house loan.

These rate of interest are tied to a base rate (individual bank's benchmark rate). For Islamic house financing, it follows the Sharia Law and comes in 2 typical types: Bai' Bithaman Ajil (BBA) or Musharakah Mutanaqisah (MM). Bai' Bithaman Ajil is when the bank buys the home at existing market rate and sells it back to you at a much greater rate.

You will then slowly buy the bank's part of the residential or commercial property through leasing (where a portion of the rental goes to paying for the purchase of a part of the bank's share in the residential or commercial property until the property pertains to your total ownership). Sharia law forbids the payment or receipt of interest, indicating that Muslims can not use traditional home mortgages.

The smart Trick of How To Look Up Mortgages On A Property That Nobody is Discussing

The ideal reverse home loan borrowers likewise are those who have built up significant and varied retirement savings. "However they have significant wealth in their house and they desire as much spendable funds in their retirement as possible," said Jack Guttentag, teacher of financing emeritus at the Wharton School of the University of Pennsylvania (which type of interest is calculated on home mortgages?).

If you do not completely understand the mortgage, you must also avoid it. "These are intricate items," Nelson said. "It's a mind tornado to think of equity disappearing."If you desire to leave your house to your children after you pass away or vacate the house, a reverse home loan isn't a good alternative for you either.

If you don't make your home tax and insurance coverage payments, that might set off a foreclosure. Similarly, if you don't respond to yearly correspondence from your loan provider, that could also trigger foreclosure proceedings. Sadly, minor offenses like not returning a residency postcard, missing tax or residential or commercial property insurance coverage payment, or bad servicing can lead to foreclosure rapidly.

If your partner is not a co-borrower on the reverse mortgage when you die, what happens next depends on when the reverse home loan was gotten. If it was secured on or after Aug. 4, 2014, a non-borrowing partner can remain in the home after the borrower passes away however does not get anymore of the loan funds as long as he or she meets these eligibility requirements: Married to the borrower when the loan closed Remain wed up until the debtor passes away Called as a non-borrowing spouse in the loan files Live and continue to reside in the house as the primary house Able to show legal ownership after the borrower passes away Pay the taxes and insurance coverage and keep the house's upkeepThe borrower and partner must accredit at the loan's closing and every list below year that they are still married and the partner is a qualified non-borrowing spouse.

If these conditions aren't met, the partner can deal with foreclosure. For reverse home mortgages taken out before Aug. 4, 2014, non-borrowing spouses have fewer protections - how do mortgages work in canada. The loan provider does not need to enable the non-borrowing partner to remain in the house after the borrower dies. A customer and his/her spouse can ask a lender to use to HUD to allow the non-borrowing partner to stay in your home.

Some lenders offer HECM lookalikes but with loan limitations that exceed the FHA limit. These reverse home mortgages typically are similar to HECMs. But it's crucial to comprehend any distinctions. Know how your reverse mortgage expert makes money. If paid on commission, be careful if the expert motivates you to take the maximum in advance cash, which implies a larger commission.

"Individuals do not take a look at reverse home loans till it becomes a requirement. They can be desperate."There are other methods for elders to unlock the equity they https://finance.yahoo.com/news/wesley-financial-group-sees-increase-150000858.html built up in their houses over the decades without securing a reverse home mortgage. If you require the equity for your retirement years, it's crucial to think about all alternatives.

The smart Trick of What Is A Min Number For Mortgages That Nobody is Talking About

The disadvantage is providing up the household home. But prospective advantages include moving closer to family https://www.trustpilot.com/review/timesharecancellations.com and purchasing a home preferable for aging in location. which of the following statements is true regarding home mortgages?. You can either re-finance or take out a new home loan if you do not have an existing one and money out a few of the equity.

You might also borrow versus your home equity using a home equity loan or line of credit. A loan enables you to take a swelling sum upfront that you repay in installation payments. With a credit line, you can obtain from it at any time, up to the maximum amount.