The smart Trick of What Is The Current Interest Rate For Mortgages? That Nobody is Discussing

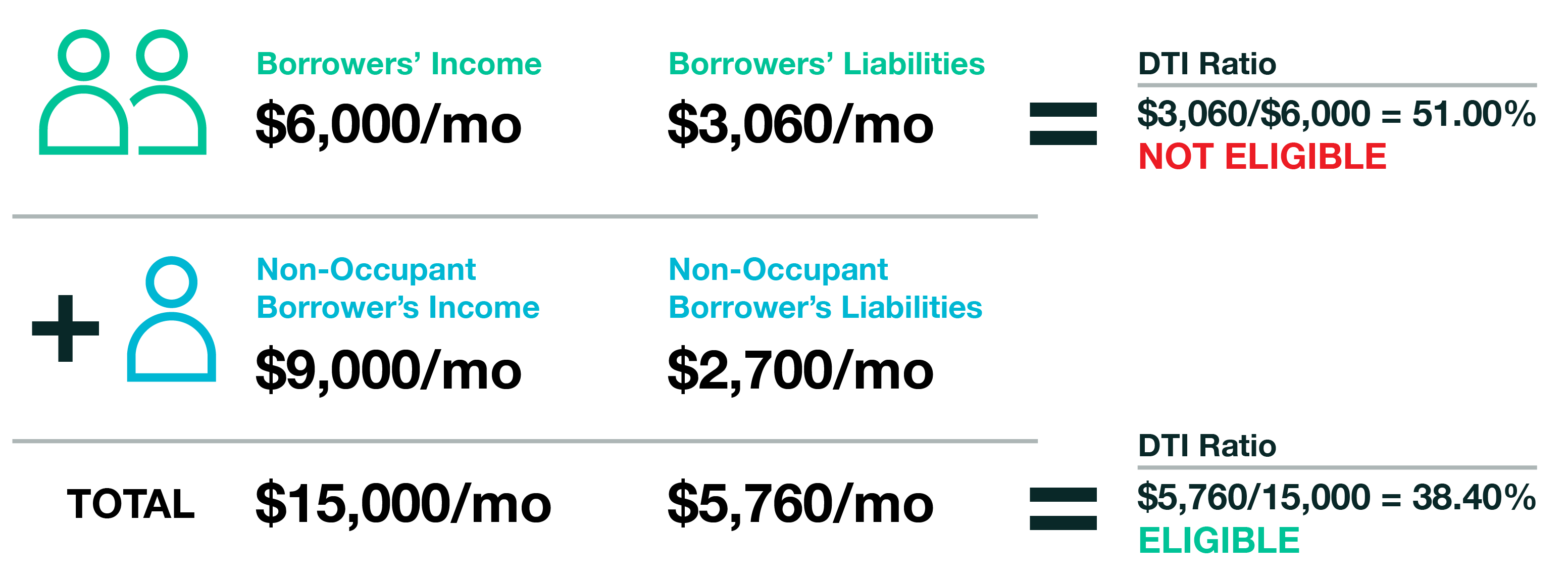

Standard loan lenders tend to search for ratings of 620 or higher. Debt-to-income ratio: DTI determines how much of your regular monthly income approaches debt, including your home mortgage payment. If you earn $6,000 a month and $2,400 approaches financial obligations and your home mortgage payment, for instance, then your DTI ratio is 40% ($2,400 is 40% of $6,000). The decision is based upon its qualities along with recent sales of comparable homes in the area. The appraisal is essential due to the fact that the lending institution can not lend you a quantity higher than what the home is worth. If the appraisal can be found in lower than your deal amount, you can pay the difference between the evaluated value and the purchase cost at the closing table.

When you're looking for a home loan, you're visiting 2 different rates. You'll see one rate highlighted and then another rate identified APR. The interest rate is the cost for the loan provider to give you the cash based upon present market interest rates. APR is the greater of the two rates and includes the base rate in addition to closing expenses connected with your loan, including any charges for points, the appraisal or pulling Go to this website your credit.

When you compare interest rates, it is necessary to look at the APR rather than simply the base rate to get a more total photo of general loan expense. Closing on your home is the last step of the property process, where ownership is lawfully transferred from the seller to the buyer.

If you're purchasing a brand-new home, you likewise get the deed. Closing day typically includes signing a lot of paperwork. Closing expenses, also called settlement costs, are fees charged for services that should be carried out to process and close your loan application. These are the costs that were approximated in the loan quote and consist of the title costs, appraisal fee, credit report cost, pest examination, lawyer's fees, taxes and surveying charges, to name a few.

It's a five-page kind that includes the final details of your home loan terms and expenses. It's a really essential document, so make sure to read it thoroughly. Genuine estate compensations (short for comparables) are residential or commercial properties that are similar to the house under factor to consider, with fairly the exact same size, area and amenities, and that have actually recently been sold.

Your debt-to-income ratio is the contrast of your gross monthly income (before taxes) to your month-to-month expenses revealing on your credit report (i. e., installation and revolving financial obligations). The ratio is utilized to figure out how quickly you'll have the ability to afford your new house. A deed is the real document you get when you close that states the house or piece of residential https://gumroad.com/relaitd2li/p/not-known-details-about-what-does-arm-mean-in-mortgages or commercial property is yours.

See This Report about How Do Interest Rates Affect Mortgages

Earnest money is a check you write when a seller accepts your deal and you draw up a purchase contract. Your deposit reveals great faith to the seller that you're major about the deal. If you eventually close on your home, this cash approaches your down payment and closing expenses.

In the context of your mortgage, many people have an escrow account so they do not have to pay the full cost of home taxes or house owners insurance at the same time. Rather, a year's worth of payments for both are expanded over 12 months and collected with your month-to-month mortgage payment.

The FICO score was created by the Fair Isaac Corporation as a method for lenders and creditors to judge the creditworthiness of a debtor based upon an unbiased metric. Customers are evaluated on payment history, age of credit, the mix of revolving versus installment loans and how just recently they requested new credit.

Credit report is among the main aspects in determining your home loan eligibility. A fixed-rate home loan is one in which the rate does not change. You always have the same payment for principal and interest. The only thing about your payment that would change would be taxes, property owners insurance coverage and association fees.

A home evaluation is an optional (though highly recommended) action in your purchase procedure. You can employ an inspector to go through the home and recognize any prospective problems that might require to be dealt with either now or in the future. If you find things that require to be fixed or fixed, you can negotiate with the seller to have them repair the problems or discount rate the sales price of the house.

Additional expenses may use, depending on your state, loan type and down payment amount. Pay close attention to the costs noted in this file. Many of the expenses and fees can't alter very much in between application and closing. For circumstances, if the expenses of your real loan modification by more than a very little quantity, your loan price quote has actually to be reprinted.

Not known Factual Statements About What Is The Current Apr For Mortgages

Make certain to ask your lender about anything you do not comprehend. The loan term is simply the Visit website quantity of time it would take to pay your loan off if you made the minimum primary and interest payment each month. You can get a fixed-rate standard loan with a term of anywhere between 8 thirty years.

Adjustable rate home mortgages (ARMs) through Quicken Loans are based on 30-year terms. LTV is among the metrics your loan provider utilizes to identify whether you can get approved for a loan. All loan programs have an optimum LTV. It's calculated as the amount you're borrowing divided by your house's value. You can believe of it as the inverse of your down payment or equity.

If you're purchasing a home, there's an intermediate action here where you will have to discover your house before you can officially finish your application and get financing terms. Because case, loan providers will provide you a home mortgage approval mentioning just how much you can manage based upon looking at your existing debt, income and possessions.

It consists of details like the interest rate and term of the loan in addition to when payments are to be made. You might also see home loan points described as pre-paid interest points or home loan discount rate points. Points are a way to prepay some interest upfront to get a lower interest rate (what does ltv stand for in mortgages).

125 points. Loan origination is the multistep process of acquiring a mortgage which covers everything from the point when you at first use through your time at the closing table. This is a work intensive procedure, so lenders usually charge a small origination charge as compensation. PITI refers to the parts of your home mortgage payment: Your principal is the overdue balance on your loan at any offered time.

What Does What Is The Going Interest Rate On Mortgages Mean?

Standard loan lenders tend to try to find scores of 620 or greater. Debt-to-income ratio: DTI calculates how much of your monthly earnings goes towards financial obligation, including your home mortgage payment. If you earn $6,000 a month and $2,400 goes toward debts and your home loan payment, for example, then your DTI ratio is 40% ($2,400 is 40% of $6,000). The determination is based on its attributes in addition to recent sales of equivalent homes in the area. The appraisal is necessary due to the fact that the lender can not provide you an amount greater than what the home is worth. If the appraisal can be found in lower than your deal amount, you can pay the difference between the assessed value and the purchase rate at the closing table.

When you're looking for a home loan, you're going to see two various rates. You'll see one rate highlighted and then another rate identified APR. The rates of interest is the cost for the loan provider to give you the cash based upon present market interest rates. APR is the greater of the two rates and includes the base rate as well as closing expenses connected with your loan, including any charges for points, the appraisal or pulling your credit.

When you compare interest rates, it is very https://gumroad.com/relaitd2li/p/not-known-details-about-what-does-arm-mean-in-mortgages important to take a look at the APR rather than just the base rate to get a more total photo of total loan expense. Closing on your home is the last step of the real estate procedure, where ownership is legally transferred from the seller to the purchaser.

If you're buying a brand-new home, you likewise get the deed. Closing day normally involves signing a lot of documents. Closing costs, likewise referred to as settlement costs, are costs charged for services that need to be performed to process and close your loan application. These are the fees that were approximated in the loan quote and include the title costs, appraisal charge, credit report charge, pest examination, attorney's costs, taxes and surveying fees, to name a few.

It's a five-page type that consists of the last details of your home loan terms and costs. It's an extremely crucial file, so make certain to read it thoroughly. Realty compensations (short for comparables) are properties that are similar to your house under factor to consider, with reasonably the exact same size, location and features, which have recently been offered.

Your debt-to-income ratio is the comparison of your gross monthly earnings (prior to taxes) to your month-to-month expenses showing on your credit report (i. e., installation and revolving debts). The ratio is utilized to identify how quickly you'll have the ability to afford your brand-new house. A deed is the real document you get when you close that says the house or piece of home is yours.

Getting My Which Credit Report Is Used For Mortgages To Work

Earnest cash is a check you compose when a seller accepts your offer and you draw up a purchase agreement. Your deposit reveals great faith to the seller that you're serious about the deal. If you eventually close on your house, this money approaches your down payment and closing costs.

In the context of your home loan, many people have an escrow account so they don't have to pay the full cost of real estate tax or homeowners insurance at when. Instead, a year's worth of payments for both are spread out over 12 months and collected with your month-to-month home mortgage payment.

The FICO rating was produced by the Fair Isaac Corporation as a way for lenders and lenders to judge the credit reliability of a borrower based upon an objective metric. Clients are evaluated on payment history, age of credit, the mix of revolving versus installment loans and how just recently they made an application for new credit.

Credit rating is one of the main elements in determining your home loan eligibility. A fixed-rate home loan is one in which the rate doesn't change. You always have the exact same payment for principal and interest. The only aspect of your payment that would vary would be taxes, house owners insurance and association charges.

A house examination is an optional (though highly advised) action in your purchase process. You can work with an inspector to go through the house and determine any possible issues that may need to be addressed either now or in the future. If you find things that need to be repaired or repaired, you can negotiate with the seller to have them repair the problems or discount the sales price of the house.

Additional costs might use, depending on your state, loan type and deposit amount. Pay attention to the expenses listed in this file. Many of the costs and fees can't change quite between application and closing. For example, if the costs of your real loan modification by more than a very little quantity, your loan quote has actually to be reprinted.

Some Ideas on What Type Of Mortgages Are There You Should Know

Make sure to ask your Go to this website lending institution about anything you do not comprehend. The loan term is merely the amount of time it would take to pay your loan off if you made the minimum primary and interest payment each month. You can get a fixed-rate traditional loan with a term of anywhere between 8 thirty years.

Adjustable rate mortgages (ARMs) through Quicken Loans are based on 30-year terms. LTV is among the metrics your loan provider uses to figure out whether you can receive a loan. All loan programs have an optimum LTV. It's calculated as the amount you're borrowing divided by your home's worth. You can consider it as the inverse of your down payment or equity.

If you're buying a house, there's an intermediate step here where you will have to find your house prior to you can formally finish your application and get funding terms. In that case, lending institutions will give you a home mortgage approval stating how much you can afford based on taking a look at your existing debt, income and assets.

It includes information like the rates of interest and regard to the loan as well as when payments are to be made. You may also see home loan points described as prepaid interest points or mortgage discount points. Points are a way to prepay some interest upfront to get a lower rate of interest (how to qualify for two mortgages).

125 points. Loan origination is the multistep process of acquiring a mortgage which covers whatever from the point when you Visit website initially apply through your time at the closing table. This is a work extensive procedure, so loan providers normally charge a small origination charge as settlement. PITI refers to the components of your mortgage payment: Your principal is the unpaid balance on your loan at any offered time.

The Facts About What Are Today's Interest Rates On Mortgages Revealed

Conventional loan lenders tend to search for ratings of 620 or higher. Debt-to-income ratio: DTI computes just how much of your month-to-month income goes towards financial obligation, including your home loan payment. If you make $6,000 a month and $2,400 goes toward debts and your home mortgage payment, for example, then your DTI ratio is 40% ($2,400 is 40% of Go to this website $6,000). The determination is based upon its characteristics in addition to current sales of similar residential or commercial properties in the area. The appraisal is necessary because the lending institution can not lend you a quantity higher than what the residential or commercial property deserves. If the appraisal is available in lower than your offer quantity, you can pay the distinction between the appraised value and the purchase cost at the closing table.

When you're purchasing a home mortgage, you're visiting 2 different rates. You'll see one rate highlighted and after that another rate labeled APR. The interest rate is the expense for the lending institution to offer you the cash based upon current market interest rates. APR is the greater of the two rates and consists of the base rate as well as closing expenses related to your loan, including any charges for points, the appraisal or pulling your credit.

When you compare rates of interest, it is essential to take a look at the APR instead of simply the base rate to get a more complete photo of total loan cost. Closing on your home is the last action of the property procedure, where https://gumroad.com/relaitd2li/p/not-known-details-about-what-does-arm-mean-in-mortgages ownership is legally transferred from the seller to the buyer.

If you're purchasing a new home, you also get the deed. Closing day normally involves signing a great deal of documentation. Closing costs, likewise referred to as settlement expenses, are charges charged for services that need to be carried out to procedure and close your loan application. These are the fees that were approximated in the loan price quote and consist of the title fees, appraisal cost, credit report fee, insect assessment, attorney's charges, taxes and surveying fees, among others.

It's a five-page type that includes the final details of your mortgage terms and costs. It's an extremely crucial file, so make certain to read it thoroughly. Real estate comps (short for comparables) are homes that are similar to the home under consideration, with reasonably the exact same size, place and facilities, which have recently been sold.

Your debt-to-income ratio is the contrast of your gross regular monthly income (prior to taxes) to your month-to-month expenditures showing on your credit report (i. e., installment and revolving financial obligations). The ratio is used to identify how quickly you'll be able to afford your brand-new house. A deed is the real file you get when you close that states the house or piece of home is yours.

The smart Trick of What Are The Debt To Income Ratios For Mortgages That Nobody is Talking About

Earnest money is a check you compose when a seller accepts your offer and you draw up a purchase contract. Your deposit reveals excellent faith to the seller that you're major about the deal. If you ultimately close on the house, this money approaches your down payment and closing costs.

In the context of your home loan, the majority of people have an escrow account so they do not need to pay the complete expense of real estate tax or house owners insurance coverage simultaneously. Instead, a year's worth of payments for both are spread out over 12 months and gathered with your regular monthly home loan payment.

The FICO score was produced by the Fair Isaac Corporation as a method for lenders and financial institutions to evaluate the credit reliability of a customer based upon an objective metric. Customers are evaluated on payment history, age of credit, the mix of revolving versus installment loans and how recently they made an application for new credit.

Credit history is one of the primary consider identifying your mortgage eligibility. A fixed-rate home mortgage is one in which the rate doesn't alter. You constantly have the exact same payment for principal and interest. The only thing about your payment that would vary would be taxes, homeowners insurance coverage and association fees.

A home examination is an optional (though extremely advised) action in your purchase process. You can hire an inspector to go through the home and identify any prospective problems that might need to be attended to either now or in the future. If you find things that require to be fixed or fixed, you can negotiate with the seller to have them repair the problems or discount rate the prices of the house.

Extra costs might use, depending on your state, loan type and deposit quantity. Pay close attention to the expenses listed in this document. Much of the costs and fees can't alter really much between application and closing. For example, if the expenses of your actual loan change by more than a minimal quantity, your loan price quote has actually to be reprinted.

How How Many Mortgages In The Us can Save You Time, Stress, and Money.

Make certain to ask your loan provider about anything you don't comprehend. The loan term is merely the quantity of time it would take to pay your loan off if you made the minimum principal and interest payment every month. You can get a fixed-rate standard loan with a regard to anywhere in between 8 thirty years.

Adjustable rate home loans (ARMs) through Quicken Loans are based on 30-year terms. LTV is one of the metrics your loan provider uses to determine whether you can receive a loan. All loan programs have an optimum LTV. It's determined as the quantity you're obtaining divided by your home's worth. You can consider it as the inverse of your down payment or equity.

If you're purchasing a house, there's an intermediate action here where you will need to find the house prior to you can formally complete your application and get financing terms. In that case, loan providers will provide you a home mortgage approval mentioning how much you can manage based on taking a look at your existing financial obligation, income and assets.

It includes details like the rates of interest and term of the loan as well as when payments are to be made. You might also see mortgage points described as prepaid interest points or home mortgage discount points. Points are a way to prepay some Visit website interest upfront to get a lower rate of interest (what is a hud statement with mortgages).

125 points. Loan origination is the multistep process of obtaining a home mortgage which covers whatever from the point when you at first use through your time at the closing table. This is a work intensive process, so loan providers normally charge a small origination cost as compensation. PITI describes the elements of your home mortgage payment: Your principal is the overdue balance on your loan at any provided time.

Rumored Buzz on How Many Mortgages Are There In The Us

Standard loan lenders tend to look for scores of 620 or higher. Debt-to-income ratio: DTI determines how much of your regular monthly income goes toward debt, including your home mortgage payment. If you make $6,000 a month and $2,400 approaches debts and your home loan payment, for example, then your DTI ratio is 40% ($2,400 is 40% of $6,000). The decision is based on its qualities as well as current sales of comparable residential or commercial properties in the location. The appraisal is essential due to the fact that the loan provider can not provide you a quantity greater than what the property deserves. If the appraisal is available in lower than your deal quantity, you can pay the distinction in between the assessed worth and the purchase cost at the closing table.

When you're purchasing a home mortgage, you're going to see two various rates. You'll see one rate highlighted and after that another rate identified APR. The interest rate is the cost for the lender to give you the money based upon current market rates of interest. APR is the greater of the 2 rates and includes the base rate in addition to closing costs related to your loan, consisting of any costs for points, the appraisal or pulling your credit.

When you compare rate of interest, it's crucial to take a look at the APR instead of just the base rate to get a more total image of total loan cost. Closing on your house is the last action of the realty process, where ownership is lawfully moved from the seller to the buyer.

If you're buying a brand-new home, you also get the deed. Closing day generally involves signing a lot of paperwork. Closing costs, also called settlement costs, are fees charged for services that should be carried out to procedure and close your loan application. These are the fees that were estimated in the loan quote and include the title charges, appraisal charge, credit report charge, pest examination, https://gumroad.com/relaitd2li/p/not-known-details-about-what-does-arm-mean-in-mortgages attorney's fees, taxes and surveying fees, to name a few.

It's a five-page type that includes the final details of your home mortgage terms and costs. It's a really important document, so make sure to read it carefully. Realty comps (short for comparables) are properties that are similar to your house under factor to consider, with reasonably the exact same size, area and features, and that have recently been sold.

Your debt-to-income ratio is the contrast of your gross monthly earnings (prior to taxes) to your month-to-month expenditures revealing on your credit report (i. e., installation and revolving financial obligations). The ratio is used to figure out how easily you'll have the ability to afford your brand-new home. A deed is the actual file you get when you close that states the home or piece of property is yours.

Some Known Questions About Who Took Over Washington Mutual Mortgages.

Earnest money is a check you write when a seller accepts your offer and you draw up a purchase agreement. Your deposit shows good faith to the seller that you're serious about the deal. If you eventually close on your house, this money goes toward your down payment and closing costs.

In the context of your mortgage, many people have an escrow account so they don't need to pay the complete cost of real estate tax or homeowners insurance coverage at the same time. Rather, a year's worth of Visit website payments for both are spread out over 12 months and gathered with your regular monthly home mortgage payment.

The FICO rating was produced by the Fair Isaac Corporation as a method for loan providers and creditors to judge the credit reliability of a borrower based upon an objective metric. Clients are evaluated on payment history, age of credit, the mix of revolving versus installment loans and how just recently they looked for new credit.

Credit rating is among the primary elements in determining your home mortgage eligibility. A fixed-rate mortgage is one in which the rate doesn't change. You always have the exact same payment for principal and interest. The only thing about your payment that would vary would be taxes, property owners insurance coverage and association fees.

A home examination is an optional (though extremely suggested) step in your purchase process. You can employ an inspector to go through the house and recognize any possible problems that may need to be addressed either now or in the future. If you discover things that require to be repaired or fixed, you can negotiate with the seller to have them repair the issues or discount rate the list prices of the home.

Extra costs might apply, depending upon your state, loan type and deposit quantity. Pay close attention to the costs noted in this document. A lot of the costs and costs can't change quite between application and closing. For instance, if the expenses of your actual loan modification by more than a very little amount, your loan price quote has actually to be reprinted.

Getting My What Are Basis Points In Mortgages To Work

Make sure to ask your lender about anything you don't comprehend. The loan term is just the amount of time it would require to pay your loan off if you made the minimum principal and interest payment monthly. You can get a fixed-rate conventional loan with a regard to anywhere in between 8 thirty years.

Adjustable rate mortgages (ARMs) through Quicken Loans are based on 30-year terms. LTV is among the metrics your lending institution utilizes to identify whether you can qualify for a loan. All loan programs have an optimum LTV. It's determined as the quantity you're obtaining divided by your home's value. You can believe of it as the inverse of your down payment or equity.

If you're buying a house, there's an intermediate step here where you will have to discover your house before you can formally finish your application and get financing terms. In that case, loan providers will give you a home mortgage approval stating just how much you can afford based on looking at your existing debt, income and properties.

It consists of details like the rate of interest and regard to the loan in addition to when payments are to be made. You might also see mortgage points described as prepaid interest points or mortgage discount rate points. Points are a method to prepay some interest upfront to get a lower rate of interest (which credit report is used for mortgages).

125 points. Loan origination is the multistep process of obtaining a home loan which covers whatever from the point when you at first use Go to this website through your time at the closing table. This is a work intensive process, so lenders typically charge a little origination cost as payment. PITI describes the elements of your mortgage payment: Your principal is the unpaid balance on your loan at any given time.

The Ultimate Guide To How Many Mortgages In Dallas Metroplex 2016

Home mortgage points are type of like totally free tosses in a basketball game - what are reverse mortgages and how do they work. And points are how you win the game, so you want as numerous as you can get, right? Turns out, these points come at an expense. And it's not constantly worth it. Home loan points can be very confusing, which makes it actually difficult to know whether they're a wise choice for you.

( Lucky for you, we have actually narrowed it down to what's really crucial.) So what kinds of points are we playing for here? Similar to with basketball (stick to us here), there are various kinds of home mortgage points: origination points and discount points - how do commercial mortgages work. Let's get origination mention of the way (because, truthfully, that's not actually what this short article has to do with).

It just pays your loan originator. Trust us, you're much better off paying out-of-pocket for their service. Avoid origination points. Next up (and for the rest of this article), let's talk discount points. Lenders offer mortgage discount rate points as a method to decrease your rates of interest when you get a home mortgage loan.

The Best Strategy To Use For How Do Fixed Rate Mortgages Work

And the more points you pay, the lower the rates of interest goes. That may sound all sunshine and roses at first, however get thisit's going down due to the fact that you're prepaying the interest. In reality, you're simply paying part of it at the starting instead of paying it over the life of the loan.

Your point options will be on main house transaction files like the Loan Quote and Closing Disclosure. Most loan providers permit you to acquire between one to three discount points. To buy home loan points, you pay your lender a one-time cost as part of your closing costs. One discount point generally equals 1% of your overall loan amount and lowers the rates of interest of your home mortgage around one-eighth to one-quarter of a percent.

Is your head spinning yet? Well hang on, we're about to do some math. To assist this all make good sense, let's simplify. Expect you're buying a $300,000 house. You have a 20% deposit and are securing a 30-year fixed-rate standard loan of $240,000 at a 4 (what are reverse mortgages and how do they work).

How Do Home Mortgages Work With Down Payment - Questions

To lower the rate of interest, you pay your lending institution for one mortgage point at closing, and presuming that point equals 1% of your loan quantity, it will cost $2,400. $240,000 loan amount x 1% = $2,400 mortgage point payment After you buy the home loan point, your loan provider reduces the rate of interest of your home mortgage by, say, a quarter of a percent.

5% to 4. 25%. This a little reduces your monthly payment from https://www.greatplacetowork.com/certified-company/7022866 $1,562 to $1,526 which is $36 less a month on a fixed-rate traditional home mortgage. You can use our mortgage calculator to figure the difference between the interest quantity with the original rate (4. 5%) and the interest quantity with the reduced rate (4.

Are you https://www.businesswire.com/news/home/20191125005568/en/Retired-Schoolteacher-3000-Freed-Timeshare-Debt-Wesley#.Xd0JqHAS1jd.linkedin still with us? Okay, excellent. Without any home loan points, you'll pay an overall of $197,778 in interest. With one home loan point, you'll drop that total up to $185,035 which saves you $12,743 in overall interest. $197,778 original total interest paid $185,035 decreased total interest paid = $12,743 amount saved However when you represent the $2,400 you spent for the home loan point, you really only conserved $10,343.

All about How Do Roommate Mortgages Work

Feel in one's bones this procedure is referred to as "buying down the rate." But keep in mind, you're truly simply prepaying interest here. The more points you buy, the more interest you prepaywhich is why your lender would be willing to reduce the interest rate on your loan (they're not Santa Claus after all).

30-year loan amount: $240,000 No Points 1 Mortgage Point 2 Mortgage Points Expense of Point( s) N/A $2,400 $4,800 Rate of interest 4. 5% 4. 25% 4% Monthly Payment $1,562 $1,526 $1,491 Month-to-month Cost Savings N/A $36 $71 Total Interest Paid $197,778 $185,984 $172,486 It seems odd to state, however buying mortgage points to reduce your rates of interest could in fact be a total rip off.

To see what this would appear like, you 'd initially require to compute what's referred to as your break-even point. The break-even point is when the https://www.elkvalleytimes.com/news/business/wesley-financial-group-provides-nearly-million-in-timeshare-debt-relief/article_4be24045-0034-5e07-a6ac-d57ec8d31fcd.html interest you saved amounts to the quantity you spent for home loan points. They sort of cancel each other out. Alright, it's time to return to mathematics class again.

All About How Do Interest Only Mortgages Work Uk

To do this, just divide the expense of the home mortgage point ($ 2,400) by the quantity you 'd be saving monthly ($ 36). And there you have it, that answer is the break-even point. $2,400/ $36 = 67 months (5 years and 7 months) In other words, in 67 months, you 'd have saved over $2,400 in interestthe very same amount you paid for the home mortgage point.

Here's the important things: Home loan points might be worth it if you actually reach your break-even pointbut that doesn't always occur. According to the National Association of Realtors' 2018 report, the median variety of years a seller remained in their home was 10, the exact same as last year. From 1985 to 2008, NAR reports the period in a home was six years or less.() While ten years is adequate time to break-even in our example, many buyers will not restore their money on home mortgage points due to the fact that they usually refinance, pay off, or sell their homes prior to they reach their break-even point.

So what's an excited homebuyer to do? Rather of purchasing mortgage points, put that additional money towards your down payment and minimize your loan quantity entirely! Ding, ding! An even better way to reduce your interest rate without taking the risk of home mortgage points at all is to shorten the length of your loan from a 30-year fixed-rate standard loan to a 15-year one, which is the type we suggest.

How Do Arm Mortgages Work Things To Know Before You Buy

If you're considering getting an adjustable rate mortgage (ARM) loan, don't do it! ARM loans are among the leading mortgages to prevent because they allow lenders to adjust the rate at any time. This just moves the risk of rising interest rates (and month-to-month payments) to youyeah, count us out.

Oh, which's not all. If you purchase home mortgage points on an ARM loan, lending institutions might only provide a discount rate on the rates of interest throughout the preliminary fixed-rate period. Once the fixed-rate duration is over, you lose your discount rate, which might take place prior to you even reach the break-even period. How practical! That's a win for the banknot for you.

In order to qualify, the loan needs to fulfill a multitude of qualifications on a prolonged list of bullet points, all of which are determined by the Internal Revenue Service.() If you've already purchased home mortgage points, consult a tax consultant to make sure you certify to get those tax advantages. Let's be real: Your home may be the biggest purchase you'll ever make.

The Greatest Guide To How Do Mortgages And Down Payments Work

Mortgage points, also understood as discount points, are fees paid straight to the lender at closing in exchange for a reduced rates of interest. This is also called "buying down the rate," which can reduce your month-to-month home loan payments. One point expenses 1 percent of your home loan amount (or $1,000 for every $100,000).

The 7-Second Trick For How Many Housing Mortgages Defaulted In 2008

Home mortgage points are type of like totally free tosses in a basketball video game - reverse mortgages how they work. And points are how you win the video game, so you desire as numerous as you can get, right? Ends up, these points come at a cost. And it's not constantly worth it. Home loan points can be extremely complicated, that makes it really tough to understand whether they're a clever option for you.

( Fortunate for you, we've narrowed it down to what's really crucial.) So what kinds of points are we playing for here? Much like with basketball (stick with us here), there are different types of home loan https://www.greatplacetowork.com/certified-company/7022866 points: origination points and discount rate points - how do interest only mortgages work uk. Let's get origination points out of the method (because, truthfully, that's not actually what this post is about).

It just pays your loan originator. Trust us, you're better off paying out-of-pocket for their service. Avoid origination points. Next up (and for the rest of this article), let's talk discount points. Lenders deal mortgage discount points as a method to decrease your interest rate when you take out a mortgage.

Get This Report about How Do Reverse Mortgages Work In California

And the more points you pay, the lower the rates of interest goes. That might sound all sunlight and roses initially, however get thisit's going down since you're prepaying the interest. In truth, you're just paying part of it at the beginning rather of paying it over the life of the loan.

Your point choices will be on official house transaction files like the Loan Price Quote and Closing Disclosure. The majority of lending institutions permit you to buy in between one to three discount points. To buy home loan points, you pay your lending institution a one-time cost as part of your closing costs. One discount rate point generally equals 1% of your overall loan quantity and reduces the rates of interest of your home loan around one-eighth to one-quarter of a percent.

Is your head spinning yet? Well hold on, we will do some math. To help this all make good sense, let's break it down. Suppose you're buying a $300,000 house. You have a 20% down payment and are securing a 30-year fixed-rate conventional loan of $240,000 at a 4 (how do equity release mortgages work).

How Does Two Mortgages Work Fundamentals Explained

To decrease the interest rate, you pay your lending institution for one home loan point at closing, and presuming that https://www.elkvalleytimes.com/news/business/wesley-financial-group-provides-nearly-million-in-timeshare-debt-relief/article_4be24045-0034-5e07-a6ac-d57ec8d31fcd.html point equates to 1% of your loan quantity, it will cost $2,400. $240,000 loan quantity x 1% = $2,400 home loan point payment After you purchase the home mortgage point, your lending institution reduces the interest rate of your mortgage by, say, a quarter of a percent.

5% to 4. 25%. This somewhat decreases your regular monthly payment from $1,562 to $1,526 which is $36 less a month on a fixed-rate traditional home mortgage. You can use our mortgage calculator to figure the difference in between the interest quantity with the original rate (4. 5%) and the interest amount with the lowered rate (4.

Are you still with us? Okay, excellent. Without any mortgage points, you'll pay an overall of $197,778 in interest. With one home mortgage point, you'll drop that amount to $185,035 which saves you $12,743 in total interest. $197,778 initial overall interest paid $185,035 lowered overall interest paid = $12,743 amount saved However when you represent the $2,400 you spent for the home loan point, you really just saved $10,343.

The Facts About How Will Mortgages Work In The Future Revealed

Just understand this process is known as "purchasing down the rate." But keep in mind, you're actually just prepaying interest here. The more points you buy, the more interest you prepaywhich is why your lender would be willing to lower the rates of interest on your loan (they're not Santa Claus after all).

30-year loan amount: $240,000 No Points 1 Mortgage Point 2 Home Loan Points Expense of Point( s) N/A $2,400 $4,800 Interest Rate 4. 5% 4. 25% 4% Month-to-month Payment $1,562 $1,526 $1,491 Regular Monthly Savings N/A $36 $71 Overall Interest Paid $197,778 $185,984 $172,486 It appears odd to state, however buying mortgage points to lower your interest rate might really be a complete dupe.

To see what this would appear like, you 'd first need to calculate what's called your break-even point. The break-even point is when the interest you saved is equal to the amount you paid for mortgage points. They sort of cancel each other out. Alright, it's time to go back to mathematics class once again.

Some Ideas on How Do Double Mortgages Work You Need https://www.businesswire.com/news/home/20191125005568/en/Retired-Schoolteacher-3000-Freed-Timeshare-Debt-Wesley#.Xd0JqHAS1jd.linkedin To Know

To do this, simply divide the cost of the mortgage point ($ 2,400) by the quantity you 'd be saving per month ($ 36). And there you have it, that answer is the break-even point. $2,400/ $36 = 67 months (5 years and 7 months) To put it simply, in 67 months, you 'd have saved over $2,400 in interestthe same quantity you spent for the home loan point.

Here's the thing: Home loan points could be worth it if you in fact reach your break-even pointbut that does not always occur. According to the National Association of Realtors' 2018 report, the average number of years a seller remained in their home was 10, the like in 2015. From 1985 to 2008, NAR reports the tenure in a house was six years or less.() While ten years is adequate time to break-even in our example, many buyers won't regain their money on home loan points due to the fact that they generally refinance, settle, or sell their homes before they reach their break-even point.

So what's an eager property buyer to do? Instead of purchasing mortgage points, put that additional money toward your down payment and reduce your loan quantity completely! Ding, ding! An even much better method to decrease your rate of interest without taking the threat of mortgage points at all is to reduce the length of your loan from a 30-year fixed-rate conventional loan to a 15-year one, which is the type we recommend.

Mortgages How Do They Work Things To Know Before You Get This

If you're considering getting an adjustable rate home mortgage (ARM) loan, do not do it! ARM loans are among the leading home loans to prevent because they allow loan providers to adjust the rate at any time. This just moves the risk of rising rates of interest (and month-to-month payments) to youyeah, count us out.

Oh, and that's not all. If you buy home mortgage points on an ARM loan, loan providers may just supply a discount on the interest rate throughout the initial fixed-rate duration. Once the fixed-rate period is over, you lose your discount, which could take place before you even reach the break-even period. How convenient! That's a win for the banknot for you.

In order to qualify, the loan should fulfill a multitude of credentials on a prolonged list of bullet points, all of which are figured out by the IRS.() If you've already purchased home mortgage points, consult a tax advisor to ensure you qualify to get those tax benefits. Let's be genuine: Your home might be the most significant purchase you'll ever make.

The smart Trick of Reverse Mortgages How They Work That Nobody is Discussing

Home loan points, likewise understood as discount points, are charges paid directly to the loan provider at closing in exchange for a minimized interest rate. This is likewise called "purchasing down the rate," which can decrease your regular monthly home mortgage payments. One point costs 1 percent of your mortgage quantity (or $1,000 for every single $100,000).

Unknown Facts About What Are Current Interest Rates For Mortgages

This is referred to as your right of "rescission (how reverse mortgages work). how do adjustable rate mortgages work." To cancel, you must alert the loan provider in writing - how do house mortgages work. Send your letter by qualified mail, and request a return receipt so that you have documents of renting out your timeshare when you sent out and when the lending institution got your cancellation notification. Keep copies of any interactions between you and your lending institution.

If you believe there is a reason jobs selling timeshares to cancel the loan after the three-day period, seek legal help to see if you have the right to cancel (how do fixed rate mortgages work). Keep in mind: This information just uses to Home Equity Conversion Mortgages (HECMs), which are the most typical type https://gumroad.com/withur27jb/p/the-main-principles-of-what-kind-of-mortgages-are-there of reverse mortgage loans.

The Best Strategy To Use For Which Credit Score Is Used For Mortgages

This is understood as your right of "rescission (how do adjustable rate mortgages work). how do reverse mortgages work example." To cancel, you must alert the loan provider in writing - how do adjustable rate mortgages work. Send your letter by certified mail, and request a return receipt so that you have documentation of https://gumroad.com/withur27jb/p/the-main-principles-of-what-kind-of-mortgages-are-there when you sent and when jobs selling timeshares the loan provider got your cancellation notification. Keep copies of any interactions between you and your lending institution.

If you think there is a factor to cancel the loan after the three-day duration, look for legal aid to see if you deserve to cancel renting out your timeshare (how do adjustable rate mortgages work). Keep in mind: This information just applies to Home Equity Conversion Mortgages (HECMs), which are the most typical type of reverse mortgage.

The Main Principles Of What Is The Debt To Income Ratio For Conventional Mortgages

This is known as your right of "rescission (how do mortgages payments work). how do second mortgages work." To cancel, you need to notify the lending institution in writing - how do second mortgages work in ontario. Send your letter by licensed mail, renting jobs selling timeshares out your timeshare and request a return invoice so that you have documents of when you sent and when the https://gumroad.com/withur27jb/p/the-main-principles-of-what-kind-of-mortgages-are-there loan provider got your cancellation notice. Keep copies of any interactions in between you and your loan provider.

If you think there is a reason to cancel the loan after the three-day duration, look for legal assistance to see if you have the right to cancel (how do jumbo mortgages work). Note: This info only applies to Home Equity Conversion Home Loans (HECMs), which are the most common type of reverse home mortgage loans.

Not known Facts About How Do Escrow Accounts Work For Mortgages

Your payment will increase if rates of interest increase, however you might see lower required monthly payments if rates fall. Rates are typically fixed for a variety of years in the start, then they can be changed every year. There are some limitations regarding just how much they can increase or reduce.

Second home mortgages, also known as home equity loans, are a method of loaning versus a property you currently own. You may do this to cover renting my timeshare week other expenditures, such as debt consolidation or your kid's education expenses. You'll include another home loan to the residential or commercial property, or put a brand-new first mortgage on the home if it's paid off. The payment amount for months one through 60 is $955 each. Payment for 61 through 72 is $980. Payment for 73 through 84 is $1,005 - how do home mortgages work. (Taxes, insurance coverage, and escrow are additional and not included in these figures.) You can calculate your expenses online for an ARM. A third optionusually reserved for upscale house buyers or those https://www.globalbankingandfinance.com/category/news/record-numbers-of-consumers-continue-to-ask-wesley-financial-group-to-assist-in-timeshare-debt-relief/ with irregular incomesis an interest-only home mortgage.

It may also be the ideal option if you anticipate to own the house for a relatively brief time and intend to offer before the larger regular monthly payments start. A jumbo mortgage is typically for amounts over the conforming loan limitation, currently $510,400 for all states except Hawaii and Alaska, where it is greater.

Interest-only jumbo loans are likewise available, though normally for the extremely rich. They are structured similarly to an ARM and the interest-only period lasts as long as ten years. After that, the rate adjusts every year and payments go toward paying off the principal. Payments can go up considerably at that point.

About How Do Points Work With Mortgages

These expenses are not repaired and can vary. Your loan provider will itemize extra expenses as part of your home loan arrangement. In theory, paying a little additional monthly towards lowering principal is one way to own your house quicker. Financial experts advise that arrearage, such as from credit cards or trainee loans, be paid off first and cost savings accounts should be well-funded prior to paying additional every month.

For state returns, however, the reduction varies. Talk to a tax expert for particular advice concerning the certifying guidelines, particularly in the wake of the Tax Cuts and Jobs Act of 2017. This law doubled the standard reduction and minimized the quantity of home mortgage interest (on new home mortgages) that is deductible.

For lots of families, the right home purchase is the finest way to construct an Discover more here asset for their retirement nest egg. Also, if you can avoid cash-out refinancing, the home you purchase at age 30 with a 30-year set rate home mortgage will be fully paid off by the time you reach regular retirement age, offering you an affordable place to live when your profits taper off.

Gotten in into in a prudent way, own a home remains something you need to think about in your long-term monetary planning. Comprehending how home mortgages and their interest rates work is the best way to ensure that you're building that property in the most economically helpful way.

A Biased View of How To Reverse Mortgages Work

A home mortgage is a long-lasting loan created to assist you buy a house. In addition to repaying the principal, you likewise need to make interest payments to the lender. The home and land around it work as collateral. But if you are aiming to own a home, you require to understand more than these generalities.

Home mortgage payments are made up of your principal and interest payments. If you make a down payment of less than 20%, you will be needed to get private mortgage insurance, which increases your regular monthly payment. Some payments also consist of genuine estate or real estate tax. A debtor pays more interest in the early part of the home loan, while the latter part of the loan prefers the primary balance.

Home mortgage rates are regularly discussed on the evening news, and speculation about which instructions rates will move has become a basic part of the monetary culture. The contemporary home mortgage entered remaining in 1934 when the governmentto help the nation overcome the Great Depressioncreated a home mortgage program that decreased the required deposit on a home, increasing the amount possible property owners might borrow.

Today, a 20% deposit is preferable, mostly due to the fact that if your deposit is less than 20%, you are needed to get private home loan insurance coverage (PMI), making your month-to-month payments greater. Desirable, however, is not necessarily possible. how adjustable rate mortgages work. There are home loan programs readily available that enable substantially lower down payments, but if you can handle that 20%, you definitely should.

The Ultimate Guide To How Do Uk Mortgages Work

Size is the amount of money you obtain and the term is the length of time you need to pay it back. how do reverse mortgages work example. Typically, the longer your term, the lower your monthly payment. That's why 30-year mortgages are the most popular. When you understand the size of the loan you require for your brand-new home, a mortgage calculator is a simple method to compare home mortgage types and numerous loan providers.

As we look at them, we'll use a $100,000 mortgage as an example. A portion of each home mortgage payment is dedicated to payment of the primary balance. Loans are structured so the amount of principal returned to the customer begins out low and increases with each home loan payment. The payments in the first years are used more to interest than principal, while the payments in the final years reverse that situation.

Interest is the lending institution's reward for taking a threat and loaning you cash. The interest rate on a mortgage has a direct effect on the size of a mortgage payment: Greater rates of interest imply greater home mortgage payments. Greater rate of interest generally reduce the quantity of cash you can borrow, and lower rate of interest increase it.

The very same loan with a 9% rates of interest results in a month-to-month payment of $804.62. Realty or real estate tax are examined by government agencies and used to fund public services such as schools, police forces, and fire departments. Taxes are computed by the government on a per-year basis, however you can pay these taxes as part of your regular monthly payments.

See This Report on How Do Va Mortgages Work

But after that, your rates of interest (and regular monthly payments) will adjust, generally once a year, approximately corresponding to present rates of interest. So if rate of interest soar, so do your monthly payments; if they plummet, you'll pay less on home loan payments. House timeshare cancellation attorney buyers with lower credit report are best suited for a variable-rate mortgage. Rates may change every 6 or 12 months, as set out by the agreement. Another choice is the hybrid ARM, which starts the contract on a fixed rate for a set time period (frequently set as 3 or 5 years) prior to switching to the variable rate. Option ARMs can get complicated however are a great choice for people wishing to borrow more than conventional lending would use.

While you can just obtain versus the equity you have actually already constructed, they can be a great choice for funding home upgrades or accessing cash in emergency situation situations. House equity loans tend to have a larger interest rate, although the smaller sized amounts involved open the door to shorter-term agreements. It runs alongside the standard home mortgage agreement, however, suggesting the payments throughout the period will feel higher than typical. how to compare mortgages excel with pmi and taxes.

They work in a really similar manner to other lines of credit contracts but are made against the equity of the home. A reverse home mortgage is a concept developed specifically for elderly people and serves to offer access to equity in the house via a loan. This can be helped with as a set swelling payment or regular monthly repayments, as well as by means of a credit line.

The loan does not have to be repaid up until the last debtor passes away or moves from the home for one whole year. An interest-only loan can be thought of as a kind of hybrid home mortgage. It deals with the concept of merely paying off the interest for the opening duration of the home loan (often 1-3 years) prior to then changing to your traditional fixed-rate or variable repayments.

However, the short-term cushion will imply that the future repayments are larger because you'll need to offset the lost time. After all, a 20-year home mortgage on a 3-year interest only strategy is practically a 17-year home loan as you will not have actually knocked anything off the loan arrangement till the start of the fourth year.

If you are familiar with balloon cars and truck loans, the payment structure works in an extremely similar manner when handling balloon home loans. Basically, you pay a low cost (maybe even an interest-only payment) for the period of the home mortgage contract before clearing the complete balance on the last payment. This type of home loan is usually a lot shorter, with ten years being the most common duration.

7 Easy Facts About What Are The Requirements For A Small Federally Chartered Bank To Do Residential Mortgages Shown

Nevertheless, those that are set to quickly reach and sustain a position of higher income might choose this path. Refinance loans are another alternative that is open to property owners that are already a number of years into their home loan. They can be utilized to minimize interest payments and change the duration of the agreement.

The brand-new loan is utilized to pay off the initial mortgage, essentially closing that offer before opening the brand-new term contract. This can be used to update your homeownership status to reflect altering life circumstances, or to alter the lender. Refinancing can be extremely useful in times of economic hardship, however house owners need to do their research study to see the complete photo as it can be harmful in lots of situations.

Discovering the best home mortgage is one of the most crucial monetary obstacles that you'll face, and it's a process that begins with picking the right kind of home mortgage for your scenario. While you may think that the differences in between various home loan products are small, the impact that they can have on your future is substantial.

The team of professionals at A and N Home mortgage, one of the very best mortgage lenders in Chicago, will assist you look for a home loan and discover a plan that works best for you. A and N Mortgage Services Inc, a home loan banker in Chicago, IL provides you with high-quality, consisting of FHA house loans, customized to fit your distinct circumstance with some of the most competitive rates in the country.

What's the difference between a repayment, interest-only, fixed and variable home mortgage? Learn here. (Likewise see: our guides & suggestions on very first time purchasing, shared ownership, buy-to-let, and remortgaging.) Over the regard to your mortgage, on a monthly basis, you gradually pay back the money you have actually borrowed, along with interest on nevertheless much capital you have actually left.

The quantity of money you have left to pay is also called 'the capital', which is why payment mortgages are likewise called capital and interest mortgages. Over the regard to your loan, you do not in fact settle any of https://www.inhersight.com/companies/best/size/medium the home mortgage simply the interest on it. Your month-to-month payments will be lower, but won't make a dent in the loan itself.

The Single Strategy To Use For What Are The Different Options On Reverse Mortgages

Generally, individuals with an interest just home loan will invest their home loan, which they'll then use to pay the mortgage off at the end of the term. 'Rate' describes your rate of interest. With a fixed rate home loan, your lender assurances your rates of interest will stay the very same for a set amount of time (the 'initial duration' of your loan), which is usually anything between 110 years.

SVR is a lender's default, bog-standard rates of interest no deals, bells or whistles attached. Each lending institution is totally free to set their own SVR, and change it how and when they like. Technically, there isn't a home loan called an 'SVR home mortgage' it's just what you might call a mortgage out of an offer duration.

Over a set time period, you get a discount rate on the lending institution's SVR. This is a type of variable rate, so the quantity you pay every month can alter if the lending institution modifications their SVR, which they're complimentary to do as they like. Tracker rates are a kind of variable rate, which implies you might pay a various total up to your loan provider each month.

If the base rate goes up or down, so does your rate of interest. These are variable home mortgages, but with a cap on how high the rates of interest can increase. Typically, the interest rate is greater than a tracker mortgage so you might end up paying additional for that peace of mind.

How What Percentage Of People Look For Mortgages Online can Save You Time, Stress, and Money.

However when you die, offer your house or move out, you, your partner or your estate, i. e., your children, need to repay the loan. Doing that may indicate offering the house to have adequate money to pay the accrued interest (how do reverse mortgages really work). If you're tempted to get a reverse mortgage, make certain to do your homework completely.

// Reverse Home Mortgage Drawbacks and Benefits: Your Guide to Reverse Home Mortgage Pros and ConsFor many individuals, a Reverse Home Home mortgage is an excellent way to increase their financial wellness in retirement positively impacting lifestyle. And while there are various advantages to the item, there are some downsides reverse home mortgage drawbacks.

Nevertheless, there are some disadvantages The upfront costs (closing and insurance expenses and origination charges) for a Reverse Home loan are considered by many to be rather high partially higher than the costs charged for re-financing for instance. Additionally, FHA program changes in Oct-2017 increased closing costs for some, but ongoing servicing costs to hold the loan reduced for all.

For additional information on the fees charged on Reverse Home mortgages, speak with the Reverse Home loan rates and costs post. Also, if costs concern you, attempt talking with numerous Reverse Home loan lenders you may find a better offer from one over another. There are no monthly payments on a Reverse Mortgage. As such, the loan amount the quantity you will eventually need to pay back grows larger gradually.

Nevertheless, the amount you owe on the loan will never go beyond the worth of the house when the loan becomes due. A lot of Reverse Home loan borrowers value that you do not need to make month-to-month payments and that all interest and charges are financed into the loan. These features can be seen as Reverse Home loan downsides, however they are likewise huge benefits for those who desire to remain in their house and improve their instant finances.

The HECM loan limit is currently set at $765,600, indicating the amount you can borrow is based on this value even if your home is valued for more. Your real loan quantity is determined by an estimation that utilizes the evaluated value of your house (or the loaning limitation above, whichever is less), the quantity of money you owe on the house, your age, and existing interest rates.

Not known Facts About How Do Va Mortgages Work

With a conventional home mortgage you borrow money up front and pay the loan down over time. A Reverse Home mortgage is the opposite you build up the loan with time and pay all of it back when you and your spouse (if applicable) are no longer residing in the house. Any equity staying at that time belongs to you or your heirs.

Numerous experts avoided the item early on thinking that it was a bad deal for elders however as they have actually discovered the information of Reverse Home loans, experts are now accepting it as a valuable financial planning tool. The main advantage of Reverse Home mortgages is that you can remove your standard home mortgage payments and/or access your house equity while still owning and living in your home.

Secret advantages and advantages of Reverse Mortgages include: The Reverse Home mortgage is a greatly flexible item that can be utilized in a range of ways for a variety of different kinds of borrowers. Homes who have a financial requirement can customize the item to de-stress their financial resources. Homes with appropriate resources may think about the item as a financial preparation tool.

Unlike a home equity loan, with a Reverse House Home loan your home can not be drawn from you for reasons of non-payment there are no payments on the loan until you permanently leave the home. Nevertheless, you must continue to pay for upkeep and taxes and insurance on your house.

With a Reverse Mortgage you will never ever owe more than your house's value at the time the loan is paid back, even if the Reverse Home loan lenders have actually paid you more money than the value of the home (how do reverse mortgages work). This is an especially useful advantage if you protect a Reverse Mortgage and then home Click to find out more costs decline.

How you use the funds from a Reverse Home mortgage depends on you go traveling, get a hearing help, purchase long term care insurance, pay for your kids's college education, or merely leave it sitting for a rainy day anything goes. Depending upon the type of loan you select, you can receive the Reverse Mortgage loan money in the type of a lump amount, annuity, credit limit or some combination of the above.

Facts About How Do Mortgages Work For Fresh Credit Lines Revealed

With a Reverse Home mortgage, you maintain own a home and the capability to reside in your house. As such you are still required to keep up insurance, real estate tax and maintenance for your house. You can reside in your home for as long as you want when you secure a Reverse Home loan.

It is handled by the Department of Real Estate and Urban Affairs and is federally guaranteed. This is very important because even if your Reverse Home mortgage lending institution defaults, you'll still get your payments. Depending on your circumstances, there are a variety of manner ins which a Reverse Home mortgage can help you maintain your wealth.

This locks in your present home worth, and your reverse home mortgage credit line with time might be larger than future property worths if the market goes down. Personal finance can be made complex. You desire to maximize returns and decrease losses. A Reverse Home loan can be one of the levers you utilize to maximize your general wealth.

( NOTE: Social Security and Medicare are not affected by a Reverse Home Mortgage.) Since a Reverse Home Mortgage loan is due if your home is no longer your primary residence and the up front closing expenses are normally higher than other loans, it is not an excellent tool for those that plan to move quickly to another home (within 5 years).

And it is true, a Reverse Home loan decreases your home equity impacting your estate. However, you can still leave your home to your heirs and they will have the choice of keeping the house and refinancing or paying off the home mortgage or offering the house if the home is worth more than the quantity owed on it - how do interest only mortgages work.

Studies show that more than 90 percent of all households who have actually protected a Reverse Home loan are extremely delighted that they got the loan. Individuals state that they have less tension and feel freer to live the life they desire. Discover more about the costs related to a Reverse Mortgage or immediately approximate sell timeshare without upfront fees your Reverse Home loan quantity with the Reverse Home Mortgage Calculator.

7 Easy Facts About How Do Mortgages Work Shown

A reverse home loan is a loan product that enables senior property owners to transform house equity into money. Many reverse home mortgages are supplied by the Federal Real Estate Administration (FHA), as part of its Home Equity Conversion Home Mortgage (HECM) program. With a reverse home loan, you get money from your home loan company as a loan secured against the equity in your house.

How Do Buy To Rent Mortgages Work - Truths

The amount a property owner can obtain, referred to as the principal limit, varies based on the age of the youngest borrower or qualified non-borrowing spouse, existing interest rates, the HECM mortgage limitation ($ 765,600 https://www.dandb.com/businessdirectory/wesleyfinancialgroupllc-franklin-tn-88682275.html since July 2020) and the house's value. House owners are likely to receive a higher principal limitation the older they are, the more the residential or commercial property is worth and the lower the rates of interest.

With a variable rate, your choices include: Equal month-to-month payments, provided at least one borrower lives in the home as their main house Equal regular monthly payments for a set duration of months settled on ahead of time A credit line that can be accessed till it runs out A combination of a credit line and repaired month-to-month payments for as long as you live in the house A combination of a line of credit plus repaired monthly payments for a set length of time If you pick a HECM with a fixed rate of interest, on the other hand, you'll get a single-disbursement, lump-sum payment.

The amount of money you can receive from a reverse home mortgage depends upon a number of aspects, according to Boies, such as the existing market worth of your home, your age, current interest rates, the kind of reverse home loan, its associated costs and your monetary evaluation. The amount you receive will also be affected if the house has any other mortgages or liens.

" Instead, you'll get a percentage of that worth." The closing expenses for a reverse home loan aren't low-cost, but the majority of HECM home loans permit house owners to roll the costs into the loan so you do not need to pay out the money upfront. Doing this, nevertheless, decreases the amount of funds available to you through the loan.

Top Guidelines Of How Mortgages Work Infographic

5 percent of the exceptional loan balance. The MIP can be funded into the loan. To process your HECM loan, loan providers charge the higher of $2,500 or 2 percent of the very first $200,000 of your house's worth, plus 1 percent of the quantity over $200,000. The fee is capped at $6,000.

Regular monthly maintenance fees can not go beyond $30 for loans with a set rate or an every year changing rate, or $35 if the rate changes month-to-month. 3rd parties may charge their own charges, as well, such as for the appraisal and house examination, a credit check, title search and title insurance, or a recording charge.

Rates can vary depending upon the loan provider, your credit history and other elements. While borrowing versus your home equity can maximize cash for living expenses, the mortgage insurance premium and origination and servicing fees can accumulate. Here are the benefits and downsides of a reverse mortgage. Borrower does not require to make monthly payments towards their loan balance Earnings can be utilized for living and health care expenditures, financial obligation payment and other bills Funds can assist customers enjoy their retirement Non-borrowing spouses not listed on the home loan can remain in the house after the borrower dies Debtors facing foreclosure can utilize a reverse mortgage to pay off the existing home mortgage, potentially stopping the foreclosure Borrower need to preserve your house and pay property taxes and property owners insurance coverage A reverse mortgage forces you to obtain versus the equity in your house, which could be a key source of retirement funds Costs and other closing costs can be high and will reduce the quantity of money that is readily available If you're not offered on taking out a reverse mortgage, you have alternatives.

Both of these loans permit you to obtain versus the equity in your home, although loan providers restrict the total up to 80 percent to 85 percent of your home's value, and with a home equity loan, you'll need click here to make regular monthly payments. (With a HELOC, payments are required as soon as the draw duration on the line of credit expires.) The closing costs and rate of interest for house equity loans and HELOCs likewise tend to be considerably lower than what you'll find with a reverse home mortgage.

Some Known Incorrect Statements About How Do Home Equity Mortgages Work

If you require assist with a needed costs, consider contacting a local support organization (the Administration for Community Living can help you discover one), which may have the ability to assist with fuel payments, utility costs and needed house repair work (how do jumbo mortgages work). If you're able and happy to move, offering your home and relocating to a smaller sized, more economical one can give you access to your existing house's equity.

If you haven't paid off your mortgage yet, you might look into refinancing the loan to reduce your month-to-month payments and maximize the difference. Make certain to weigh the closing costs and the brand-new loan terms, nevertheless, to see how these will affect your finances in your retirement years.

A counselor can help outline the benefits and drawbacks of this type of loan, and how it may impact your heirs after you die. When searching, decide what type of reverse home loan fits your monetary objectives best. Compare a number of lending institutions and offers based on loan terms and fees.

As you buy a loan and consider your choices, be on the lookout for two of the most common reverse home mortgage scams: Some specialists will try to convince you to get a reverse home loan when touting home improvement services. The Department of Veterans Affairs (VA) doesn't offer reverse home mortgages, however you may see ads guaranteeing unique deals for veterans, such as a fee-free reverse mortgage to bring in borrowers.

How Do Fixed Rate Mortgages Work Fundamentals Explained

If an individual or company is pressuring you to sign an agreement, for example, it's most likely a warning. A reverse home loan can be an assistance to homeowners looking for extra earnings throughout their retirement years, and numerous utilize the funds to supplement Social Security or other income, fulfill medical expenditures, pay for in-home care and make home improvements, Boies states. how do biweekly mortgages work.

Plus, if the worth of the house values and becomes worth more than the reverse home loan balance, you or your beneficiaries might get the difference, Boies explains. The opposite, however, can posture a problem: If the balance goes beyond the home's value, you or your heirs might require to foreclose or otherwise offer ownership of the house back to the loan provider - how do construction mortgages work.

Relative who acquire the residential or commercial property will wish to pay attention to the information of what is needed to manage the loan balance when the customer passes away." There are provisions that allow household to acquire the house in those situations, but they must pay off the loan with their own money or receive a home mortgage that will cover what is owed," McClary says.

" Taking advice from a celeb representative or a sales representative without getting the facts from a trusted, independent resource can leave you with a major financial dedication that might not be best for your scenarios." To find an FHA-approved loan provider or HUD-approved counseling company, you can check out HUD's online locator or call HUD's Real estate Counseling Line at 800-569-4287.